Introduction: Understanding Inflation and the Rising Cost of Living

Over the past few years, individuals and families across the world have felt a noticeable shift in their daily expenses. From the price of essential groceries to the cost of transportation, education, healthcare, and household utilities, everything seems to be rising steadily. This continuous increase in prices, commonly known as inflation, has become a central part of everyday conversations. Whether it is around the dinner table, at workplaces, or on social media, people are increasingly concerned about how their income is struggling to keep up with their expenses.

Inflation is not just an economic term used by experts—it is a lived reality for millions of households. When the price of basic goods and services increases, the first impact is felt at home. Budgets begin to tighten, families start adjusting their lifestyle choices, and long-term financial plans often get delayed. Even small adjustments, such as buying less fresh produce, postponing a trip, or cutting down on non-essential items, reflect the silent pressure of the rising cost of living. This pressure is felt even more strongly by fixed-income households, middle-class families, and individuals trying to build savings or invest for the future.

The purpose of this article is not only to explain inflation in simple economic terms but also to connect it with the real challenges faced by everyday people. By understanding how inflation works, why it occurs, and how it spreads through different sectors of the economy, readers can become better prepared to manage their finances. More importantly, this article aims to provide a relatable perspective—highlighting how inflation influences our decisions, our priorities, and even our mindset.

Throughout this article, we will explore the major causes behind inflation, its impact on households, and the changing patterns of spending and saving. We will also look at practical strategies that individuals and families can adopt to cope with rising expenses—ranging from budgeting techniques and spending awareness to long-term planning and alternative income opportunities. Understanding inflation is the first step toward staying financially resilient in a rapidly changing world.

As we begin this journey, remember that inflation is not just an economic phenomenon—it is a personal experience. By becoming aware, adapting wisely, and taking informed decisions, we can protect our financial well-being even in challenging times. Let us now move forward to understand inflation more deeply and explore how we can manage the rising cost of living with clarity and confidence.

A Personal Story: How Inflation Changed Our Everyday Life

Inflation is often discussed as an economic concept, but for most families, it is much more than numbers or charts—it is a lived experience that quietly reshapes habits, priorities, and even dreams. My own experience with rising prices reflects exactly this shift. Just a few years ago, our household ran on a steady and predictable budget. Monthly expenses and income had a comfortable balance. But as inflation began to rise steadily, this balance started slipping away. What once cost a manageable amount suddenly required far more planning and adjustment. This gradual change forced us to rethink many aspects of our lives.

The first signs of inflation appeared in our grocery bills. One morning, while shopping with my mother, I noticed that the same rice, lentils, and cooking oil we used to buy regularly had increased in price by nearly 20–30 percent. My mother, who rarely complained, sighed and said, “We may have to cut down on some items this month.” It was a simple statement, yet it carried the weight of a bigger reality—rising prices do not just affect our spending; they influence our choices, routines, and lifestyles.

The second area where inflation hit us hard was transportation and energy costs. As fuel prices increased, the daily commute became noticeably more expensive. Public transportation fares also rose, and by the end of each month, the strain on our budget became clearer. Electricity bills followed the same trend. Running a cooler or air conditioner during the summer, something we once managed without much thought, now required deliberate decision-making. Every switch we turned on meant one more calculation in our minds.

However, the toughest impact was on essential and unavoidable expenses—education, healthcare, and long-term savings. School fees increased, textbooks became pricier, and even basic medical consultations cost more. These are not expenses one can simply ignore or postpone. For many families like ours, this meant adjusting other parts of our lifestyle. What hurt the most was watching our carefully planned savings slow down as inflation grew faster than our income. It brought a sense of uncertainty, a quiet anxiety about the future.

Hard Decisions Within the Family

Inflation forced us to revise our monthly budget from the ground up. We categorized our spending into essentials and non-essentials. Eating out, buying new clothes, weekend outings, and online subscriptions—all these became rare or were completely cut off. Though these changes sound small, they affected the emotional rhythm of the household. Sacrificing small joys is not easy, especially when they are part of family traditions.

I clearly remember one incident. Every year during festivals, we bought new clothes—a cherished tradition that brought excitement and bonding. But one year, as prices rose sharply, my mother said gently, “We can skip new clothes this time. The household needs come first.” It was a moment of quiet acceptance, a reminder that inflation does not just strain finances but also touches emotions and memories. Yet it also showed how families come together, adapting and supporting each other during difficult times.

Lessons Learned Through the Journey

This experience taught me two valuable lessons. First, financial stability depends not only on income but also on awareness and disciplined planning. Understanding where money goes, what can be reduced, and how to prioritize becomes crucial during inflationary periods. Second, inflation—no matter how challenging—can be managed when families stay united, communicate openly, and make decisions together.

Today, inflation is still rising, and the cost of living continues to climb. But we face it with more confidence and clarity because of the lessons we have learned. Our story is not unique; it mirrors the reality of millions of families trying to adapt to a changing economy while protecting their hopes and aspirations. Inflation may test us, but it also teaches resilience, awareness, and the importance of standing together.

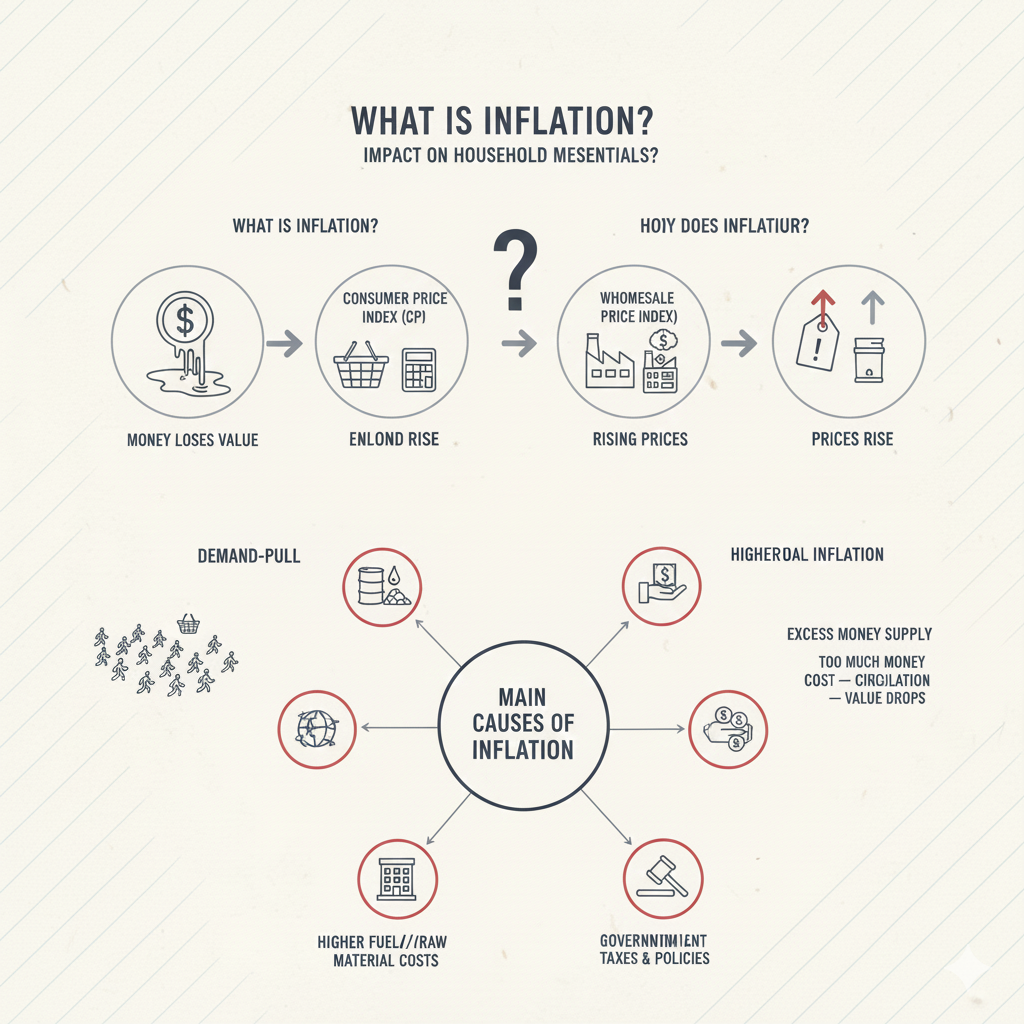

What Is Inflation?

Inflation is one of the most commonly discussed economic concepts, yet it is often misunderstood. In simple terms, inflation refers to the sustained increase in the prices of goods and services over time. When prices rise, the purchasing power of money decreases—meaning the same amount of money buys fewer items than before. For everyday families, this translates into higher grocery bills, rising transportation costs, and an overall increase in the cost of living.

Inflation is not just about products becoming expensive; it reflects deeper changes within the economic system. Factors such as demand and supply balance, production costs, government policies, global market conditions, and even natural disasters contribute to price movement. When any of these elements shift, prices respond accordingly, and households begin to feel its impact in their monthly budget.

How Is Inflation Measured?

To understand inflation accurately, economists rely on key indicators. The most widely used among them is the Consumer Price Index (CPI). CPI measures the average change in the prices of a fixed basket of goods and services that households typically consume—such as food, clothing, fuel, housing, education, and healthcare. When CPI rises, it signals that consumers are paying more for these essential categories, indicating inflation in the economy.

Another important measure is the Wholesale Price Index (WPI), which tracks price changes at the wholesale or producer level. While CPI reflects the impact on end consumers, WPI helps understand price trends earlier in the supply chain. Together, these indicators help policymakers, businesses, and analysts evaluate which sectors are experiencing greater price pressure—food, fuel, manufacturing, services, or others.

Why Does Inflation Occur?

Inflation can occur for several reasons. Sometimes, demand for goods increases faster than supply, leading to higher prices—a situation known as demand-pull inflation. Other times, the cost of raw materials, fuel, or labor rises, causing producers to increase prices; this is called cost-push inflation. Global events such as oil price shocks, currency fluctuations, pandemics, or geopolitical tensions can also influence domestic inflation.

Additionally, when a large amount of money enters circulation without a corresponding increase in production, the value of money declines, contributing to inflation. In essence, inflation is a complex yet critical economic process that shapes household budgets, consumer behavior, and financial decisions. Understanding it empowers individuals to make informed choices, adapt strategically, and protect their financial stability.

Main Causes of Inflation

Inflation does not emerge from a single factor; rather, it is the result of multiple economic, social, and global forces interacting with each other. The steady rise in prices that consumers experience is often the combined outcome of changes in demand, supply, production costs, government decisions, and global market trends. Understanding these causes helps us see why inflation occurs and how deeply it influences everyday life.

1. Imbalance Between Demand and Supply

One of the most fundamental reasons for inflation is a mismatch between demand and supply. When the demand for goods or services increases faster than the supply, prices naturally rise. This type of inflation is known as demand-pull inflation. For example, during festivals or special seasons, consumer spending spikes, leading to higher prices due to limited supply.

2. Increase in Production Costs

When the cost of producing goods rises — such as expenses related to raw materials, labor, electricity, or fuel — the selling price of the product also goes up. This is known as cost-push inflation. Fuel price hikes are a major contributor to this type of inflation, as higher transportation charges increase the cost of almost every essential product.

3. Excessive Money Supply

Inflation can occur when there is too much money circulating in the economy. When people have more money to spend but the production of goods does not increase at the same pace, prices start rising. This phenomenon is referred to as monetary inflation. It often happens when governments or central banks inject extra money into the economy to stimulate growth during recessions or crises.

4. Global Factors and International Markets

In a globally connected world, international events and market fluctuations play a major role in domestic inflation. Political tensions, wars, disruptions in global supply chains, and changes in crude oil prices directly affect the cost of goods in countries like India. A rise in global oil prices, for instance, leads to higher fuel prices locally, eventually increasing transportation and manufacturing costs.

External Factors That Influence Inflation:

- Rise in global oil prices: Increased crude oil prices make fuel, transport, and logistics more expensive.

- Geopolitical conflicts: Wars or sanctions can disrupt trade routes and supply chains.

- Natural disasters: Floods, droughts, or storms can destroy crops and reduce supply.

- Pandemics or health crises: As seen during COVID-19, production and distribution can slow drastically.

5. Government Policies and Taxes

Sometimes government decisions such as higher taxes, changes in import duties, or reduction in subsidies can lead to price increases. For instance, if GST on a product is raised, the final price for consumers rises as well. Similarly, reducing subsidies on fuel or essential commodities can create immediate inflationary pressure.

6. Lack of Competition in the Market

When only a few companies dominate a market, they can influence prices easily. Lack of competition often results in higher pricing, as consumers have fewer alternatives. This situation can cause artificial inflation, where prices rise not because of real cost increases, but because businesses have the power to set higher prices.

Understanding these causes is essential because inflation does not merely affect markets; it impacts every household budget and financial decision. By knowing why prices rise, individuals and families can prepare better, adjust their spending habits, and adopt strategies to manage the rising cost of living.

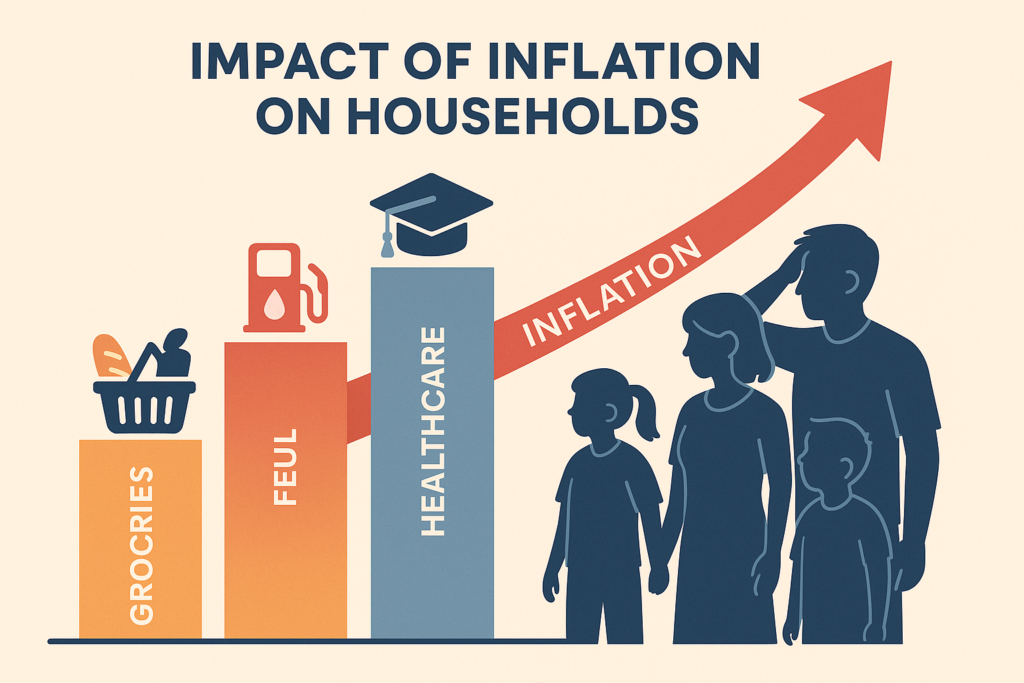

Impact of Inflation on Households

Inflation affects every household differently, but its presence is universally felt. From rising grocery prices to increasing fuel costs and higher expenses on education and healthcare, inflation silently shapes the financial decisions of families. When essential commodities become more expensive, households are forced to rethink their priorities, adjust their lifestyles, and find new ways to manage limited income. Even small changes in the prices of day-to-day items can accumulate steadily, creating noticeable pressure on the monthly budget.

1. Shrinking Monthly Budget

One of the most immediate effects of inflation is the shrinking purchasing power of families. As prices rise, the same income covers fewer expenses than before. A budget that once seemed comfortable suddenly begins to feel restrictive. Households often start cutting back on discretionary spending—such as dining out, entertainment, vacations, or personal purchases—just to make room for essential items like food, fuel, and utility bills.

Many families also experience difficulty in maintaining savings. Funds that were once set aside for emergencies, education, or long-term goals often get diverted toward meeting rising daily expenses. This shift increases financial vulnerability, making households less prepared to handle unexpected events such as medical emergencies or job loss. Over time, this decline in savings can significantly impact future financial security.

2. Changes in Consumer Preferences and Lifestyle

Inflation also influences how people make purchasing decisions. When prices rise sharply, consumers tend to compare brands more frequently, look for discounts, switch to cheaper alternatives, or reduce consumption altogether. A family that previously preferred premium household items may shift to budget-friendly options. Similarly, fresh produce, dairy products, or packaged goods may be bought in smaller quantities to manage costs.

Lifestyle adjustments become unavoidable. For example, families may:

- Limit the use of personal vehicles to reduce fuel expenses.

- Shift to public transportation or carpooling.

- Reduce electricity usage to control utility bills.

- Plan meals more strategically to avoid food waste and overspending.

These changes gradually alter daily routines and habits. Even leisure activities are affected. Outings, movies, subscriptions, and celebrations are often minimized or postponed. Over time, these adjustments can influence the emotional well-being of families as well, especially when cherished traditions or comforts are sacrificed.

3. Rising Pressure on Essential Expenses

Inflation has a deeper impact on essential and unavoidable costs. Education fees, medical bills, house rent, and insurance premiums tend to rise steadily over time. Unlike discretionary expenses, these cannot be easily reduced or avoided. When these costs increase, they disproportionately affect middle-income and lower-income families whose income does not rise as quickly as inflation.

Healthcare is among the most sensitive areas affected by inflation. Even minor increases in consultation fees, medicines, and diagnostic tests can burden the family budget. Similarly, schooling costs such as tuition, books, transportation, and uniforms place additional financial pressure on parents trying to provide quality education for their children.

4. Emotional and Psychological Impact

While inflation is usually described in numbers and percentages, its emotional impact is rarely discussed. Constantly worrying about rising costs can cause stress and anxiety. Families may feel uncertain about their financial future, especially if their income is not increasing at the same pace as prices. This emotional strain affects decision-making and overall mental well-being.

The stress of managing finances with limited resources can also affect relationships within the household. Discussions about money become more frequent, and disagreements about spending priorities may arise. Yet, for many families, such challenges also foster cooperation and unity, encouraging members to support one another and make collective decisions for long-term stability.

Ultimately, inflation reshapes the financial and emotional landscape of households. It challenges families to adapt, prioritize, and plan more carefully. By understanding how inflation impacts different aspects of daily life, households can take proactive steps to protect their financial health and build resilience against future uncertainties.

Real Case Studies and Diary Entries

While inflation is often explained using data, graphs, and economic theories, its true impact can only be understood through the experiences of real families. These short case studies and diary-style reflections reveal how rising prices quietly reshape everyday life, forcing individuals to rethink their habits, priorities, and financial plans. Each story highlights a different aspect of the struggle that inflation brings into ordinary households.

Case 1: Rising Grocery Expenses — Reena’s Story

Reena, a schoolteacher, has been noticing the steady increase in grocery prices. Two years ago, her monthly household grocery bill averaged around ₹3,500. Today, it has crossed ₹5,200. In her diary she writes:

“I returned from the market today with fewer items than usual. Prices of lentils, oil, and vegetables rise almost every month. Earlier I could plan my grocery list easily, but now I have to double-check every expense. Even basic cooking has become costlier.”

Reena’s experience mirrors the reality of countless families who feel inflation most directly in their kitchen budget. Small, consistent price hikes accumulate quickly, creating financial stress.

Case 2: Transportation Costs and Daily Struggle — Rajesh’s Note

Rajesh works in a private company and travels 25 kilometers daily. With rising fuel prices, his monthly travel expenses have jumped from ₹1,800 to nearly ₹3,000. He writes in his diary:

“Petrol prices increased again today. Commuting to work is no longer as affordable as before. I’m considering using the bus twice a week just to balance my expenses. Every small change now matters.”

Rajesh’s experience highlights how inflation influences lifestyle decisions. Fuel inflation affects more than vehicle owners—it reshapes routines, travel choices, and even work schedules.

Case 3: Education Costs on the Rise — Seema’s Concern

Seema, a mother of two school-going children, faces rising expenses related to their education. Fees, books, uniforms, and transport charges have increased by nearly 30 percent. She writes:

“Every year the school fees rise, and this year it was much more than expected. Education cannot be compromised, but we will have to adjust other expenses. Sometimes it feels like inflation grows faster than our income.”

Her words reflect the silent pressure families face when essential and unavoidable costs, like education, become significantly more expensive.

Case 4: Health Expenses and Financial Stress — Mahesh’s Experience

Mahesh, a small business owner, has watched medical costs rise steadily. Medicines and tests that once cost ₹800 monthly now exceed ₹1,200. He writes:

“Medicine prices have increased again. Even a simple doctor visit feels heavier on the pocket. Health expenses come without warning, and inflation makes them even harder to manage.”

Health-related inflation often strikes suddenly and severely, disrupting savings and long-term financial plans.

These real-life cases show that inflation is not just an economic term but a personal challenge. It impacts families emotionally, financially, and psychologically. Each household finds its own way to adapt—cutting costs, redefining priorities, and making conscious lifestyle changes. Together, these stories paint a powerful picture of how rising prices shape everyday life.

Practical Solutions: How to Manage Inflation Smartly

Inflation may not be under our direct control, but the way we respond to it can significantly change its impact on our lives. When the cost of living rises, households must adopt smarter strategies, disciplined financial planning, and conscious decision-making. The practical measures below offer a clear roadmap for families trying to stay financially stable despite rising expenses.

1. Reorganize and Review Your Budget

One of the first steps to managing inflation is restructuring the household budget. As prices rise, the old spending pattern becomes unsustainable. A carefully revised budget helps identify wasteful spending and ensures that essential needs are met without financial stress.

How to do it effectively?

- Divide your expenses into three categories: Essential, Important, and Non-Essential.

- Track your monthly expenses and compare them to identify where cuts can be made.

- Reduce discretionary spending like dining out, entertainment, and unused subscriptions.

- Create small monthly targets to manage bigger expenses effectively.

A well-organized budget gives clarity and prevents unnecessary pressure when prices fluctuate.

2. Practice Smart Shopping and Expense Management

Smart shopping is one of the most powerful tools for saving money during inflation. Even minor adjustments in purchasing habits can collectively reduce household expenses by a significant margin.

Smart shopping strategies:

- Buy in bulk: Rice, pulses, detergents, and other essentials cost less when purchased in bulk.

- Use offers and discounts wisely: Buy only the items you genuinely need.

- Choose seasonal and local products: These are fresher and usually cheaper.

- Prepare a shopping list: Helps avoid impulse purchases and stays within budget.

Over time, these small but consistent changes create long-term financial benefits.

3. Build Additional Income Streams

When inflation rises faster than income, the most effective solution is to explore alternative sources of earning. Even a small additional income stream can greatly reduce financial pressure and improve household stability.

Possible income opportunities:

- Freelancing work such as writing, design, marketing, or video editing.

- Small home-based businesses — baking, tiffin services, homemade products, tutoring.

- Skill-based services — graphic design, digital marketing, consulting.

- Renting out items such as tools, cameras, or small equipment.

Diversifying income strengthens financial resilience and creates a safety net during difficult times.

4. Long-Term Saving and Investment Strategies

Inflation reduces the real value of money, which means traditional savings alone are not sufficient. To secure the future, families must adopt investment strategies that offer returns higher than the inflation rate.

Recommended options:

- SIP in mutual funds: A reliable way to beat inflation in the long run.

- PPF/EPF and other government-backed schemes: Safe options with tax benefits.

- Health insurance: Protects against unpredictable medical expenses.

- Emergency fund: Keep savings equal to at least 6 months of essential expenses.

A balanced investment portfolio provides financial security and cushions against rising costs.

5. Reduce Consumption of Energy and Resources

Managing electricity, water, and fuel consumption can bring noticeable savings. These are recurring expenses, and optimizing them can significantly lower the monthly financial burden.

Practical tips:

- Use LED bulbs and energy-efficient appliances.

- Turn off unnecessary lights and fans when not in use.

- Practice water-saving methods inside the home.

- Adopt carpooling or switch to public transport when possible.

Small mindful habits contribute to long-term financial improvement.

6. Manage Debt Wisely

Debt can become more challenging to handle during inflation, especially if interest rates rise. Without proper management, it can lead to severe financial stress. Therefore, evaluating and optimizing debt obligations becomes essential.

Effective debt management tips:

- Prioritize high-interest loans and repay them first.

- Limit credit card usage to avoid accumulating costly debt.

- Consider refinancing options if interest rates are high.

- Ensure EMIs do not exceed 30–40% of your monthly income.

A disciplined approach to managing loans protects families from financial instability.

7. Increase Self-Reliance

During inflation, becoming more self-reliant can significantly reduce day-to-day expenses. Simple lifestyle changes can help families avoid unnecessary spending.

Self-reliance ideas:

- Grow small vegetables or herbs at home.

- Cook meals at home instead of frequently eating outside.

- Learn basic repair skills to avoid costly services.

- Reuse and recycle household items creatively.

Ultimately, inflation teaches us to be resourceful, mindful, and financially disciplined. With the right strategies, families can not only survive inflation but also become stronger and more resilient.

Policy and Society: The Role of Government and Communities During Inflation

Inflation is not only an economic phenomenon measured through indexes and charts—it also deeply influences the social structure, lifestyle, and opportunities available to different groups within society. As prices rise, the impact spreads across consumers, farmers, small businesses, industries, and the labor force. Therefore, managing inflation effectively requires coordinated efforts between government policies and societal awareness.

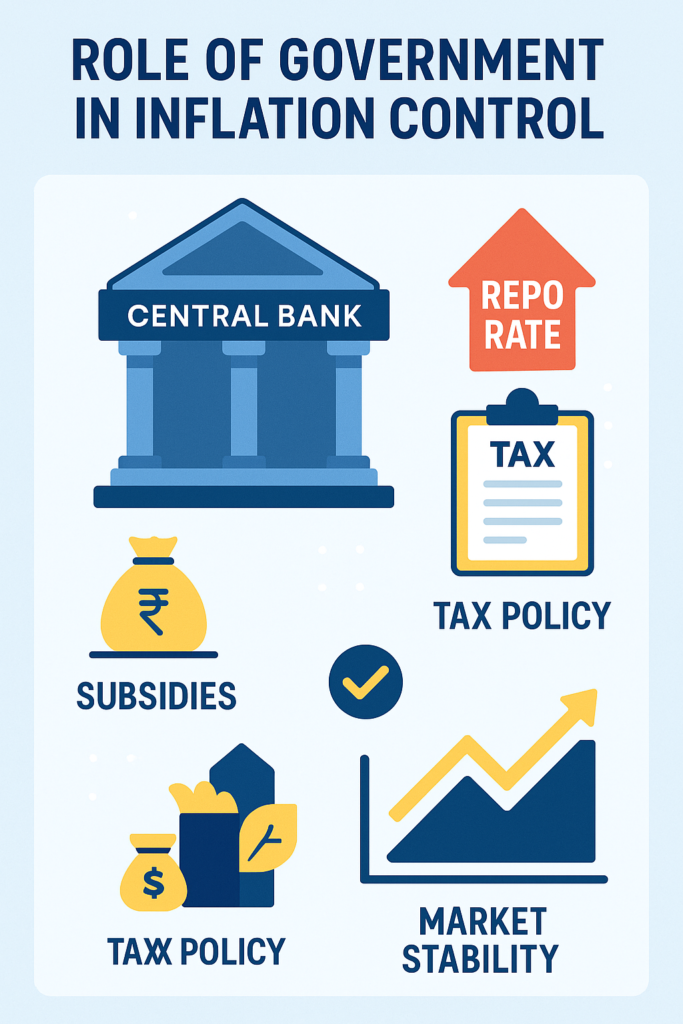

The government plays a critical role in stabilizing the market and protecting citizens from the adverse effects of rising prices. Through monetary tools such as the repo rate, central banks regulate the flow of money in the economy. When interest rates increase, borrowing becomes more expensive, reducing excessive spending and controlling inflation. Similarly, fiscal measures such as subsidies, tax reforms, import duties, and support for essential sectors can significantly influence price levels.

Society also has an important responsibility during inflationary periods. Consumer awareness, responsible usage of resources, and support for local products help reduce pressure on the economy. Community-level initiatives—such as financial literacy programs, savings awareness, and energy conservation campaigns—empower individuals to manage their finances wisely and become more resilient.

Moreover, inflation does not affect all social groups equally. Lower- and middle-income families experience a faster decline in purchasing power, while higher-income groups are relatively less impacted. This imbalance highlights the need for collective responsibility, where society extends support to vulnerable groups and promotes shared solutions.

Ultimately, inflation is a challenge that can only be addressed through partnership—between government policies that stabilize the economy and a mindful society that adapts responsibly. With effective policies and an informed public, a nation can navigate inflation while ensuring long-term economic stability and social well-being.

Conclusion: Moving Forward with Awareness and Resilience

Inflation is an economic force that touches every aspect of our daily lives—our grocery bills, transportation costs, education expenses, healthcare needs, and long-term financial plans. While we cannot control rising prices directly, we can definitely control how we respond to them. Understanding inflation and adopting the right strategies empower individuals and families to navigate financial challenges with greater stability and confidence.

Throughout this article, we explored the causes of inflation, its effects on households, and the practical steps that can help reduce the financial burden. Creating a balanced budget, making smarter purchasing decisions, exploring additional income opportunities, and adopting disciplined saving and investment habits play a crucial role in building long-term financial strength. Responsible use of resources and thoughtful lifestyle choices also contribute significantly to managing the rising cost of living.

Ultimately, inflation is not just a challenge but also a reminder—to stay prepared, stay aware, and stay adaptable. When families and communities work together with clarity and cooperation, they can overcome even the toughest economic pressures. With informed choices and consistent efforts, inflation can be managed, and a more secure future can be built.

Let inflation be a lesson, not a limitation—move forward with smart planning and resilient thinking.

Frequently Asked Questions (FAQ)

1. What is inflation?

Inflation is the economic process in which the prices of goods and services gradually increase over time, resulting in a decrease in the purchasing power of money.

2. What is the main cause of rising inflation?

The major causes of inflation include demand–supply imbalance, increased production costs, global market changes, and excessive money supply in the economy.

3. How does inflation affect common people?

Inflation raises household expenses, reduces savings, increases the cost of essential goods, and puts pressure on the daily budget of families.

4. How can we save money during inflation?

Creating a budget, cutting unnecessary expenses, buying in bulk, using discounts wisely, saving energy, and investing for the long term can help minimize the impact of inflation.

5. Can the government control inflation?

Yes. The government and central bank can regulate inflation through monetary policies, tax adjustments, subsidies, and strengthening supply chains.

6. What is the difference between inflation and cost of living?

Inflation refers to the rise in prices of goods and services, while cost of living indicates how much money an individual or family needs to maintain a basic lifestyle.

7. Does investing help protect against inflation?

Yes. Long-term investments such as mutual fund SIPs, PPF, EPF, gold, and diversified portfolios often provide returns that can outpace inflation and protect your savings.

References

- Reserve Bank of India (RBI) – Reports on inflation, monetary policy, and economic indicators https://www.rbi.org.in/

- Government of India – Consumer Price Index (CPI) and Wholesale Price Index (WPI) data https://www.mospi.gov.in/

- World Bank – Global inflation trends and economic analysis https://www.worldbank.org/

- International Monetary Fund (IMF) – Reports on global economy and inflation outlook https://www.imf.org/

- Economic Survey of India – Annual report on growth, inflation, and economic indicators https://www.indiabudget.gov.in/economicsurvey/

- World Economic Forum (WEF) – Articles on global inflation and economic trends https://www.weforum.org/