Introduction — Beginning with a Story

The early signs of a global economic slowdown rarely appear suddenly. They come quietly, through small shifts that most people overlook. I first sensed these signals during a period when everything on the surface looked stable, yet businesses and consumers had already begun to hesitate in their decisions.

Early Experience — A Short Story

A few years ago, I was working closely with a small business. I noticed that customers were placing fewer orders, suppliers were delaying payments, and an unusual sense of uncertainty was spreading through the market. At that moment, I realized that these were not random events but early indicators of an upcoming economic downturn.

Key Learning from That Experience (In Brief)

This incident taught me that recession signals do not always appear in charts or data alone—they reflect in people’s behavior, market sentiment, and everyday financial decisions. Recognizing these signs early can help us prepare more effectively for economic challenges.

Example Product Title

👉 Buy on AmazonDisclosure: As an Amazon Associate, I earn from qualifying purchases.

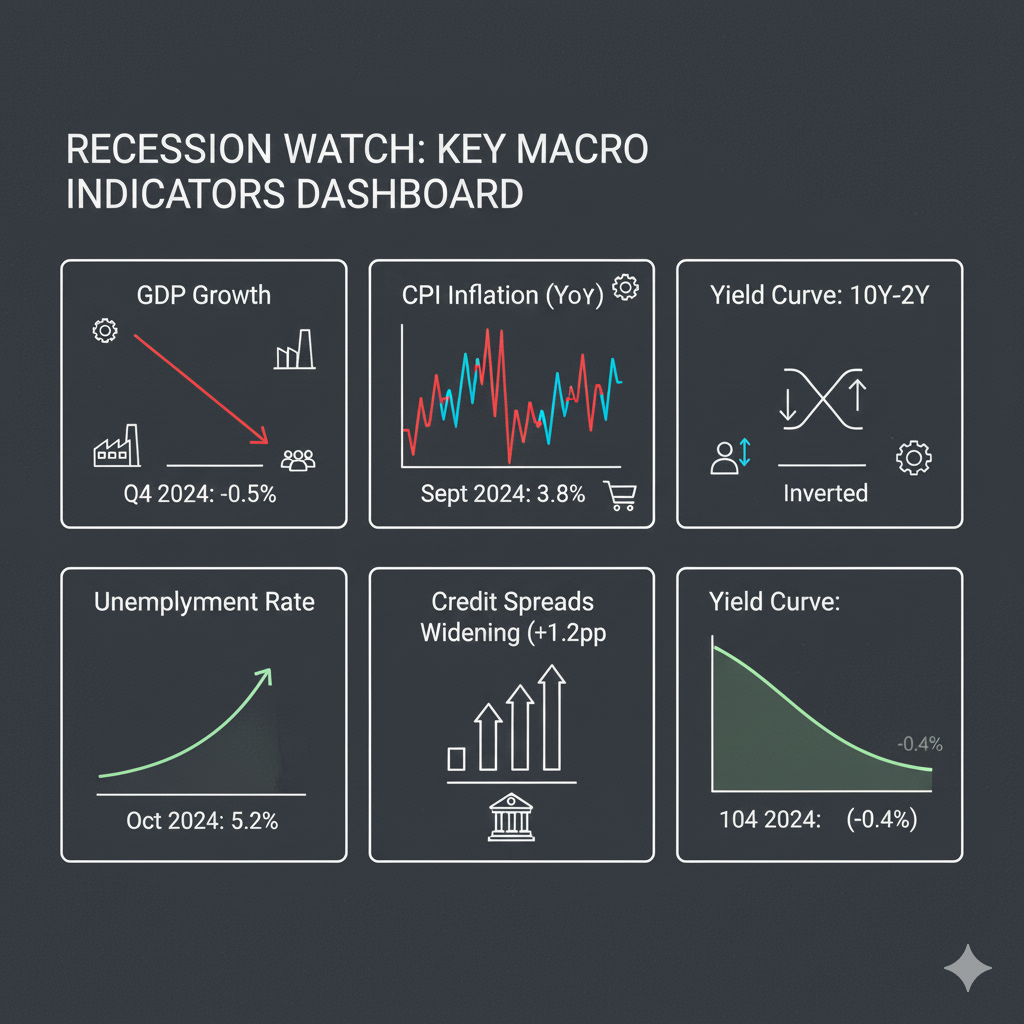

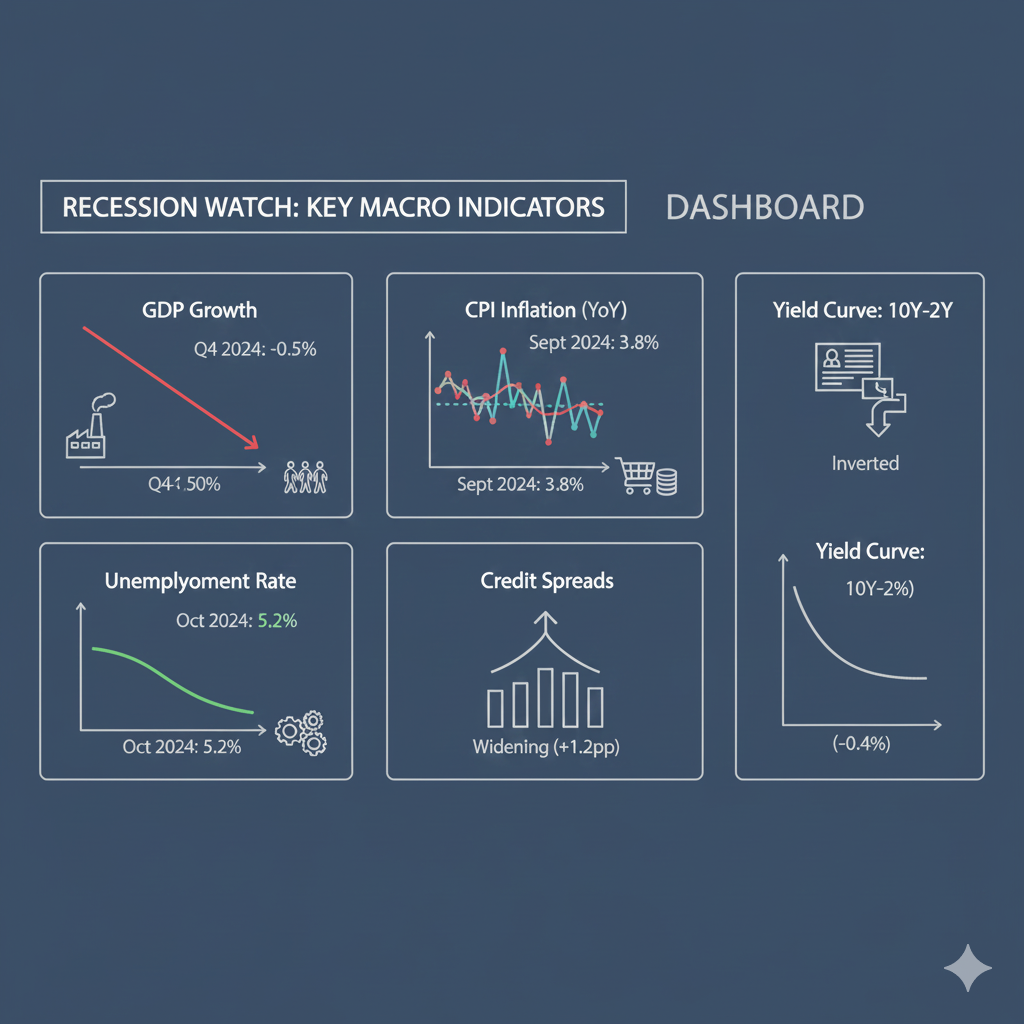

Macro Signals (Key Indicators)

Major early warnings of a recession are usually visible in macroeconomic data. Spotting these signs early—alongside real-world observations—gives individuals and businesses time to prepare.

GDP / Growth Rate Slowdown

A sustained slowdown in GDP growth is one of the clearest signals that an economy is losing momentum. If growth weakens for several consecutive quarters, it often precedes broader contractions in employment, investment, and consumption.

Which Data to Check (Exact Indicators)

- Quarterly GDP growth rates — compare quarter-on-quarter and year-on-year figures.

- Annual GDP trend — rolling 4-quarter growth to smooth seasonality.

- Gross Value Added (GVA) by sector — manufacturing, services, agriculture contributions.

- Private consumption and fixed investment figures — look for declines or stagnation.

- Industrial production indices (IPI) — manufacturing output trend.

- Retail sales and consumer spending data — real (inflation-adjusted) values matter most.

- Business investment and capacity utilization — falling utilization often precedes layoffs.

Unemployment, CPI, Credit Spreads

Other critical indicators are the labor market, inflation metrics, and financing conditions. Together these show whether demand is weakening, prices are destabilizing, or credit is drying up.

How to Read and Interpret Them

- Unemployment: Rising unemployment or falling job creation signals that firms are reducing output and hiring—an early sign of weakening demand.

- CPI / Inflation: Higher CPI means rising consumer prices (erosion of purchasing power). Conversely, falling CPI can indicate collapsing demand. Both trends are important: high inflation with falling growth (stagflation) is especially problematic.

- Credit spreads: Widening spreads between corporate bonds and risk-free rates (or between high-yield and investment-grade bonds) indicate increased perceived credit risk and tighter funding conditions.

- Combined interpretation: Use these indicators together. For example, GDP slowdown + rising unemployment + widening credit spreads forms a stronger signal than any one indicator alone.

- Timing and lag: Some indicators lead (stock market, yield curve), others lag (unemployment). Check leading indicators for early warning and lagging indicators to confirm trends.

Market Signals (Yield Curve, Stocks, Commodities)

Financial markets often show early signs of an economic slowdown. Key market indicators—like the yield curve, stock market volatility, and commodity price trends—reflect investor sentiment and real-time expectations about growth, inflation and credit conditions.

The Story Behind Each Signal (Personal Experience)

Some years ago I witnessed a market shift that started quietly: bond yields moved oddly, the stock index saw sharp intraday swings, and commodity prices—especially oil and industrial metals—began a steady decline. I noticed traders growing cautious and suppliers delaying purchases. These market movements preceded slower orders and hiring freezes at several small firms I worked with, turning market noise into a real economic problem for businesses on the ground.

What to Do — Practical Suggestions

- Diversify your portfolio: Avoid concentration in a single sector or asset class; include a mix of equities, bonds, and real assets as appropriate to your risk profile.

- Maintain liquidity: Hold an emergency cash buffer or highly liquid assets to cover expenses or margin calls during volatility.

- Manage leverage: Reduce high-interest debt and be cautious about taking on new leveraged positions when markets are unstable.

- Rebalance periodically: Review and rebalance your portfolio to align with long-term goals rather than reacting to short-term market panic.

- Monitor leading indicators: Keep an eye on the yield curve shape, VIX or volatility measures, and commodity indices for early warning signs.

- Plan for sectoral impacts: If you or your clients depend on commodity inputs or export markets, create contingency plans for supply shocks and demand drops.

Example Product Title

👉 Buy on AmazonDisclosure: As an Amazon Associate, I earn from qualifying purchases.

Sectoral Impact (Real Estate, Construction, Manufacturing)

Recessions rarely affect every sector equally. Some sectors (like real estate and construction) often give earlier warning signs, while others (like certain manufacturing subsectors) may show delayed effects. Understanding sector-specific dynamics helps business owners and professionals take targeted actions rather than generic ones.

Case Study / Short Story

Consider a mid-sized construction firm I worked with a few years ago. At first, sales and new project inquiries seemed steady, but within months orders slowed, supplier credit tightened, and several buyers requested delayed payment schedules. The developer postponed project launches, and cash flow tightened rapidly. Simultaneously, a local manufacturer I consulted noticed rising inventory and weakening inbound orders — they reduced production runs and adjusted shifts to conserve cash. These micro-stories show how market signals translate into real operational pressure on the ground.

Sector-wise Preparation (Practical Tips)

- Real Estate:

- Maintain extra liquidity — keep contingency funds for project financing gaps and refund demands.

- Assess buyer creditworthiness and rely on verified advance payments where possible.

- Include flexible payment and renegotiation clauses in contracts to manage unexpected delays.

- Construction:

- Monitor work-in-progress and inventory closely to avoid overstocking materials on slow-moving projects.

- Strengthen relationships with subcontractors and maintain a list of alternative suppliers.

- Update project timelines and cash-flow projections monthly to spot stress early.

- Manufacturing:

- Track capacity utilization and order books; reduce batch sizes or switch to make-to-order if demand softens.

- Cut fixed costs where possible (temporary layoffs, shift adjustments, selective outsourcing).

- Hedge critical raw-material exposure or negotiate longer-term supply contracts to stabilize input costs.

- Cross-sector recommendations:

- Prioritize projects/products by risk and margin — pause or postpone the highest-risk, low-margin work.

- Explore alternate revenue streams (local demand, services, smaller customized orders).

- Improve customer retention: offer maintenance, phased deliveries, or bundled services to keep cash flowing.

Policy Response (Central Bank, Fiscal)

When early recession signs appear, central banks and governments typically respond with monetary and fiscal measures—rate adjustments, liquidity support, tax relief, and targeted stimulus. These policy actions affect businesses and household finances both directly and indirectly, and timing/scale of responses can vary by country.

How Policy Will Affect Your Business / Personal Finances

Interest rate changes: Central bank rate cuts lower borrowing costs but may compress bank deposit returns; rate hikes raise loan costs and can squeeze cash flows.

Liquidity support: Measures like targeted lending facilities or central bank asset purchases make credit more available and can ease short-term funding stress.

Fiscal stimulus: Government spending, tax relief, or direct transfers can boost demand, but these measures often take time to roll out and show impact.

Regulatory shifts: Changes in banking rules, insolvency frameworks, or reporting requirements can affect operational and compliance costs for firms.

Example Product Title

👉 Buy on AmazonDisclosure: As an Amazon Associate, I earn from qualifying purchases.

Potential Options and Actions (Practical Steps)

- Review debt: Audit existing loans—rates, maturities, covenants—and evaluate refinancing if policy rates fall.

- Strengthen cash flow: Prepare updated cash-flow forecasts and maintain contingency reserves to take advantage of any temporary support schemes.

- Track government programs: Monitor eligibility for grants, tax deferrals, or sector-specific relief and apply promptly where appropriate.

- Explore alternative financing: Consider non-bank options (invoice financing, P2P, trade credit) to diversify funding sources if traditional credit tightens.

- Scenario planning: Build best/likely/worst-case financial scenarios tied to policy triggers and define action plans and KPIs for each.

- Stay informed: Follow central bank statements, budget announcements, and regulator notices to anticipate shifts and act proactively.

- Seek expert advice: Engage a financial advisor or industry association for tailored guidance on policy impacts and compliance.

Actionable Checklist (Practical Steps)

When early signs of a recession appear, taking timely and well-planned actions can protect both your business and personal finances. Below is a practical checklist you can start implementing immediately:

- Build an emergency fund: Maintain savings or liquid assets covering 6–12 months of essential expenses.

- Manage debt wisely: Prioritize paying off high-interest loans and explore refinancing options if interest rates decline.

- Diversify income sources: Avoid relying on a single client or income stream; explore secondary or alternative income paths.

- Control inventory: If you run a business, review stock levels regularly and adjust inventory according to demand trends.

- Strengthen customer relationships: Retaining customers is cheaper than acquiring new ones—improve service, communication, and loyalty programs.

- Reduce unnecessary expenses: Identify non-essential spending and cut or pause it immediately.

- Monitor key economic indicators: Track GDP growth, CPI inflation, unemployment rates, yield curves, and credit spreads regularly.

- Review your investment portfolio: Rebalance asset allocation to match your risk appetite and market conditions.

- Utilize government programs: Stay updated on tax reliefs, subsidies, grants, or loan support schemes and apply when applicable.

- Keep legal and financial documents updated: Ensure insurance, contracts, loan documents, and tax filings are accurate and up to date.

FAQ — Frequently Asked Questions

1. Is a recession always bad for the economy?

Not always. While recessions bring short-term challenges, they also correct imbalances, eliminate weak businesses, and create stronger foundations for long-term stability.

2. What are the most reliable signs of a recession?

A sustained decline in GDP, rising unemployment, an inverted yield curve, widening credit spreads, and falling consumer demand are considered the strongest indicators.

3. Does a falling stock market guarantee a recession?

No. The stock market can act as a leading indicator, but not every market drop results in a recession. It must be assessed alongside macroeconomic data.

4. What should small businesses prioritize during a recession?

Strengthening cash flow, reducing non-essential expenses, managing inventory carefully, retaining existing customers, and leveraging government support programs.

5. Can inflation and recession occur together?

Yes. This condition is known as stagflation, where growth slows down while prices remain high, making economic management more difficult.

6. How can an individual prepare for a recession?

By building an emergency fund, reducing debt, controlling spending, upgrading skills, and reviewing investment portfolios for proper risk balance.

Conclusion

A global economic slowdown never arrives suddenly; it reveals itself through subtle signals long before the impact becomes visible. Whether it is an inverted yield curve, declining consumer demand, tightening credit conditions, or rising uncertainty in business decisions—each sign carries a message. The real strength lies not in avoiding challenges but in recognizing them early and preparing with clarity and confidence.

A recession, though difficult, offers valuable lessons. It teaches us to reassess our habits, strengthen our financial foundations, diversify our income sources, and refine our long-term goals. Individuals who adapt, businesses that innovate, and professionals who upskill often emerge from downturns stronger than before. Hard economic phases test our resilience, but they also bring moments of reinvention and newfound discipline.

Example Product Title

👉 Buy on AmazonDisclosure: As an Amazon Associate, I earn from qualifying purchases.

It is important to remember that every slowdown is followed by recovery—new opportunities, new markets, and new possibilities. A recession is not an ending; it is a turning point. With awareness, preparedness, and the willingness to act decisively, you can not only withstand turbulent times but also position yourself ahead of those who wait passively. Stay resilient, stay informed, and be ready to embrace the next wave of opportunities with renewed confidence.

Sources / References

- World Bank — Global Economic Prospects and economic data reports

- International Monetary Fund (IMF) — World Economic Outlook and monetary policy analysis

- Reserve Bank of India (RBI) — Monetary policy statements and annual reports

- OECD — Economic indicators and global outlook publications

- UNCTAD — Global trade and investment reports

- National Statistical Offices (NSO) — Official GDP, CPI, and labor market data

- Financial market indicators such as the Yield Curve, VIX Index, and global commodity prices

- Leading business news portals (Bloomberg, Reuters, Economic Times) for market analysis and updates