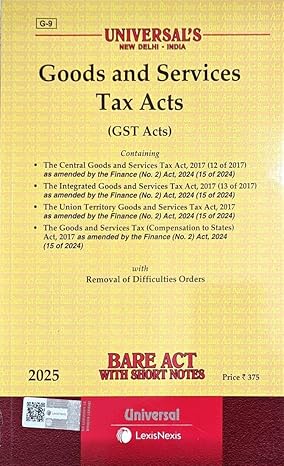

GST India

The Goods and Services Tax (GST) is a landmark reform in India’s tax system, implemented on July 1, 2017. It is an indirect tax system based on the concept of “one country, one tax, one market.” GST provides a unified framework by eliminating various indirect taxes (such as VAT, Excise Duty, and Service Tax).

Background and Need for GST

Previously, different indirect taxes were levied by different states and the central government in India. This increased the tax burden on both businesses and consumers.

- The varying rates made it difficult to do business.

- The problem of “tax on tax” (cascading effect) persisted.

- Interstate trade became increasingly complex.

To address these challenges, the need for a unified tax system (GST) was felt.

History of GST

Initial Phase

- 2000: The Government of India formed a committee that began work on the GST framework.

- 2004: The Kelkar Task Force recommended the implementation of GST.

- 2006: GST was first mentioned in the budget speech and a target was set to implement it by 2010.

Legislative Process

- 2011: The 115th Constitutional Amendment Bill was introduced.

- 2014: The NDA government prioritized GST and introduced an amended bill.

- 2016: The 122nd Constitutional Amendment Bill was passed in Parliament.

- July 1, 2017: GST was implemented across India.

GST Structure

GST in India is implemented as a Dual GST Model.

- CGST (Central GST): Collected by the Central Government.

- SGST (State GST): Collected by the State Government.

- IGST (Integrated GST): Levied on inter-state transactions.

Amazon Product

Click the button below to view full details and the latest price on Amazon.

👉 View on Amazon*As an Amazon Associate, I earn from qualifying purchases.

Key Tax Rates

GST rates are divided into different categories:

- 0% (essential goods)

- 5%

- 12%

- 18%

- 28% (luxury and harmful goods)

Impact of GST

Positive Impact

- Ease of Doing Business increased.

- The tax system became transparent.

- Tax evasion was curbed.

- Digitization and online return filing simplified the process.

Challenges

- GST compliance is challenging for small businesses.

- Frequent changes in rules and rates create confusion.

- Technical issues (GSTN Portal Issues) are encountered.

Current Status (as of 2025)

- The GST Council periodically changes rates and provisions.

- Petroleum products and alcohol are still excluded from GST.

- GST is now applicable to e-commerce and digital services.

- Revenue sharing between states and the central government is a key issue.

- Tax collection has steadily increased, making it a major source of government revenue.

Conclusion

GST is a milestone in India’s tax system. It not only simplifies business but also provides a unified market for the country. Although compliance and technical challenges still exist, with gradual improvements, GST is emerging as a robust and transparent tax system.

Introduction to GST

The Goods and Services Tax (GST) is a comprehensive indirect tax reform of India’s tax system, implemented on July 1, 2017. This tax is based on the concept of “one nation, one tax, one market.”

GST eliminated several indirect taxes (such as excise duty, service tax, VAT, entry tax, etc.) levied by the central and state governments and created a unified tax structure.

Key Features of GST

- Unified tax system: Uniform tax treatment across the country.

- Dual model: Both the central (CGST) and state (SGST) participate.

- IGST: Applies to trade between states.

- Eliminates cascading effect: Eliminates the problem of “tax on tax.”

- Digital platform-based: Registration, returns, and payments are completely online.

👉 In simple words, GST is a tax that is levied on goods and services and has made the Indian tax system more transparent, simple and integrated.

Background and Need for GST

Before 2017, the tax system in India was very complex. The central and state governments levied various indirect taxes, such as:

Central Government Taxes

- Excise Duty

- Service Tax

- Custom Duty

State Government Taxes

- Value Added Tax (VAT)

- Octroi

- Entry Tax

- Luxury Tax

This not only increased the tax burden on businesses but also created the problem of a “tax on tax” (cascading effect). For example, there was a tax on raw materials and a different tax on finished products, resulting in higher prices for the end consumer.

Why was GST Needed?

- Need for a unified tax system: Different tax rates in different states made business complex and expensive.

- Eliminate the cascading effect: A common tax system was needed to eliminate “tax on tax.”

- Ease of Doing Business: GST aimed to transform the entire country into a common market.

- Revenue Transparency: Digital platforms like GSTN made tax collection transparent and easy.

- Global Competitiveness: Many developed countries already had GST/VAT systems in place.

- Curbing Tax Evasion: GST’s online invoicing and ITC system reduced the possibility of tax evasion.

👉 In short, the background of GST was a tax system that was complex due to different state and central tax rules. It was needed to create a transparent, simple, and uniform tax structure in India, benefiting all three – consumers, businesses, and the government.

GST India

The Goods and Services Tax (GST) is a landmark reform in India’s tax system, implemented on July 1, 2017. It is an indirect tax system based on the concept of “one country, one tax, one market.” GST provides a unified framework by eliminating various indirect taxes (such as VAT, Excise Duty, and Service Tax).

Background and Need for GST

Previously, different indirect taxes were levied by different states and the central government in India. This increased the tax burden on both businesses and consumers.

- The varying rates made it difficult to do business.

- The problem of “tax on tax” (cascading effect) persisted.

- Interstate trade became increasingly complex.

To address these challenges, the need for a unified tax system (GST) was felt.

History of GST

Initial Phase

- 2000: The Government of India formed a committee that began work on the GST framework.

- 2004: The Kelkar Task Force recommended the implementation of GST.

- 2006: GST was first mentioned in the budget speech and a target was set to implement it by 2010.

Legislative Process

- 2011: The 115th Constitutional Amendment Bill was introduced.

- 2014: The NDA government prioritized GST and introduced an amended bill.

- 2016: The 122nd Constitutional Amendment Bill was passed in Parliament.

- July 1, 2017: GST was implemented across India.

GST Structure

GST in India is implemented as a Dual GST Model.

- CGST (Central GST): Collected by the Central Government.

- SGST (State GST): Collected by the State Government.

- IGST (Integrated GST): Levied on inter-state transactions.

Key Tax Rates

GST rates are divided into different categories:

- 0% (essential goods)

- 5%

- 12%

- 18%

- 28% (luxury and harmful goods)

Impact of GST

Positive Impact

- Ease of Doing Business increased.

- The tax system became transparent.

- Tax evasion was curbed.

- Digitization and online return filing simplified the process.

Challenges

- GST compliance is challenging for small businesses.

- Frequent changes in rules and rates create confusion.

- Technical issues (GSTN Portal Issues) are encountered.

Current Status (as of 2025)

- The GST Council periodically changes rates and provisions.

- Petroleum products and alcohol are still excluded from GST.

- GST is now applicable to e-commerce and digital services.

- Revenue sharing between states and the central government is a key issue.

- Tax collection has steadily increased, making it a major source of government revenue.

Conclusion

GST is a milestone in India’s tax system. It not only simplifies business but also provides a unified market for the country. Although compliance and technical challenges still exist, with gradual improvements, GST is emerging as a robust and transparent tax system.

Amazon Product

Click below to view full product details and the latest price on Amazon.

👉 View on Amazon*As an Amazon Associate, I earn from qualifying purchases.

History of GST — Detailed Timeline (2000–2017)

The implementation of the Goods and Services Tax (GST) in India was a long and phased process. It took approximately 17 years to implement. The journey began in 2000 and became a reality in 2017. Let’s understand it step by step:

Initial Ideas (2000 – 2006)

2000: The Government of India, under Prime Minister Atal Bihari Vajpayee, formed a high-powered committee to study the structure of GST.

2003 – 2004: The Kelkar Task Force on Indirect Taxes recommended the implementation of GST.

2006: Then-Finance Minister P. Chidambaram announced GST in his budget speech and set a target of implementing it by 2010.

Legislative Initiatives (2009 – 2014)

2009: A “First Discussion Paper” was released, outlining the model and workings of GST.

2011: The UPA government introduced the 115th Constitutional Amendment Bill in Parliament, but it failed to pass due to lack of political consensus.

2014: After forming the new government, the NDA prioritized GST and introduced the 122nd Constitutional Amendment Bill in the Lok Sabha.

Final Phase (2015 – 2017)

2015: The Standing Committee of Parliament examined the bill and made recommendations.

2016: In August, both houses of Parliament passed the 122nd Constitutional Amendment Bill. It was later renamed the 101st Constitutional Amendment Act, 2016.

2017:

- In March–April, the GST Council approved all GST laws (CGST, SGST, IGST, Compensation Cess).

- July 1, 2017: GST officially implemented in India.

Historical Significance

The implementation of GST is considered the biggest reform in India’s tax system. It was called a historic step towards “One Nation, One Tax, One Market.”

Early phase (2000 – 2006)

The foundation of the Goods and Services Tax (GST) in India was laid in 2000. This was a time when the country’s tax system was complex and multi-layered. The various indirect taxes levied by the various states and the central government were making it difficult to do business. It was against this backdrop that the idea of GST emerged.

Key Events

- 2000: Prime Minister Atal Bihari Vajpayee formed an Empowered Committee of State Finance Ministers to study the feasibility of implementing GST. This committee was headed by West Bengal Finance Minister Asim Dasgupta.

- 2003 – 2004: The Kelkar Task Force on Indirect Taxes stated in its report that GST implementation was necessary to simplify and make India’s tax system transparent.

- 2006: Then-Finance Minister P. Chidambaram formally announced the implementation of GST for the first time in his budget speech, setting a target of implementing GST by 2010.

Characteristics of the Initial Phase

- The idea of GST was officially discussed for the first time.

- Debates began on the tax sharing strategy between the states and the central government.

- It was considered the “next generation of tax reforms.”

👉 Thus, the period from 2000 to 2006 was the period of conceptualizing and formulating the GST.

Legislative initiatives (2009–2014)

Following the initial draft of GST, the government took several significant steps towards its implementation. This period (2009–2014) can be called the phase of legislative initiative, as it was during this period that efforts were made to lay the constitutional and legal foundation for GST.

Key Events

2009:

- Following discussions between the central government and the states, the First Discussion Paper was released.

- It outlined the potential structure of GST, the powers of the states and the central government, and the tax sharing mechanism.

- This triggered a widespread debate across the country and prompted the consultation of all stakeholders.

2011:

- The UPA government introduced the 115th Constitutional Amendment Bill in Parliament.

- Its objectives were:

- To grant constitutional status to GST.

- To grant the power to impose GST to both the central and state governments.

- However, due to a lack of political consensus and concerns about revenue loss to the states, the bill was not passed.

2012 – 2013:

- Despite several meetings, differences persisted between the states and the central government regarding compensation for revenue loss and setting tax rates.

- States believed that the implementation of GST would impact their fiscal autonomy.

2014:

- After the formation of the new government (NDA) in May 2014, GST was again prioritized.

- In December 2014, the 122nd Constitutional Amendment Bill was introduced in the Lok Sabha, further clearing the path for GST implementation.

Significance of this phase

GST was formally introduced in Parliament for the first time.

Although it failed to pass, it laid the foundation and built consensus across the country regarding GST.

This phase paved the way for the successful implementation of GST in 2016–2017.

Introduction to GST

The Goods and Services Tax (GST) is a comprehensive indirect tax reform of India’s tax system, implemented on July 1, 2017. This tax is based on the concept of “one nation, one tax, one market.”

GST eliminated several indirect taxes (such as excise duty, service tax, VAT, entry tax, etc.) levied by the central and state governments and created a unified tax structure.

Key features of GST:

- Unified tax system: Uniform tax treatment across the country.

- Dual model: Both the central (CGST) and state (SGST) participate.

- IGST: Applies to trade between states.

- Eliminates cascading effect: Eliminates the problem of “tax on tax.”

- Digital platform-based: Registration, returns, and payments are completely online.

👉 In simple words, GST is a tax that is levied on goods and services and has made the Indian tax system more transparent, simple and integrated.

Background and need for GST

Before 2017, the tax system in India was very complex. The central and state governments levied various indirect taxes, such as:

Central Government:

- Excise Duty

- Service Tax

- Custom Duty

State Governments:

- Value Added Tax (VAT)

- Octroi

- Entry Tax

- Luxury Tax

This not only increased the tax burden on businesses but also created the problem of a “tax on tax” (cascading effect). For example, there was a tax on raw materials and a different tax on finished products, resulting in higher prices for the end consumer.

Why was GST needed?

- Need for a unified tax system: Different tax rates in different states made business complex and expensive.

- Eliminate the cascading effect: A common tax system was needed to eliminate “tax on tax.”

- Ease of Doing Business: GST aimed to transform the entire country into a common market.

- Revenue Transparency: Digital platforms like GSTN made tax collection transparent and easy.

- Global Competitiveness: Many developed countries already had GST/VAT systems in place. India also had to improve its tax system to meet global standards.

- Curbing Tax Evasion: GST’s online invoicing and ITC (Input Tax Credit) system reduced the possibility of tax evasion.

👉 In short, the background of GST was a tax system that was complex due to different state and central tax rules. It was needed to create a transparent, simple, and uniform tax structure in India, benefiting all three – consumers, businesses, and the government.

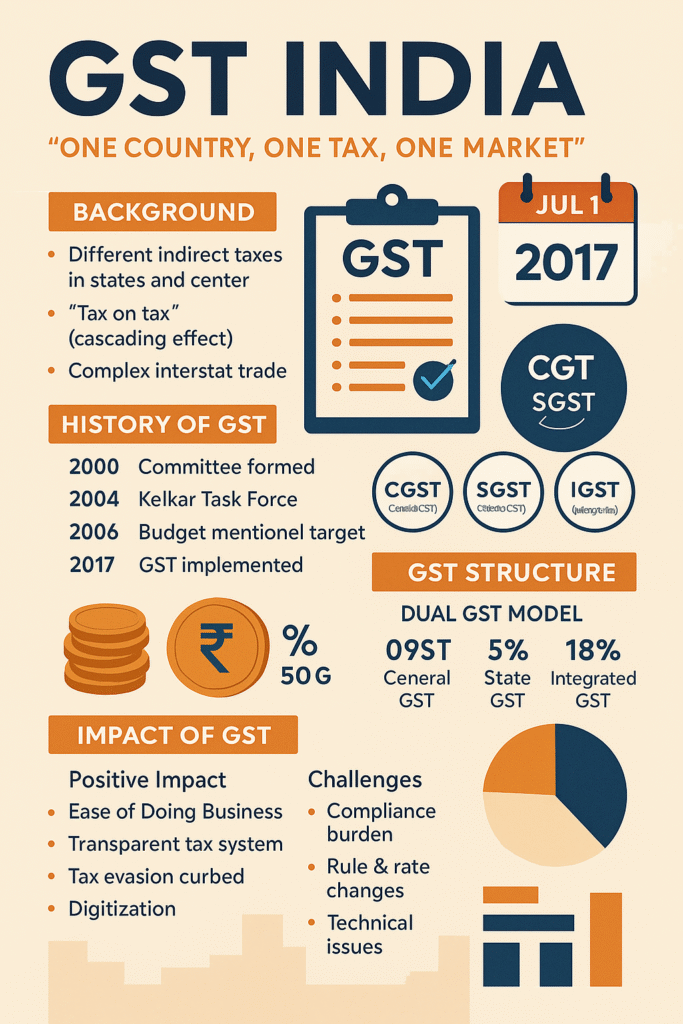

Structure of GST

The Goods and Services Tax (GST) in India is implemented as a dual GST model. This means that both the central and state governments have the power to levy taxes. This structure was considered appropriate for a country with a federal structure like India.

Central Goods and Services Tax (CGST)

- It is levied by the central government.

- It is levied on intra-state supplies of goods and services.

- Example: If an item is sold in Delhi, the central government will levy CGST on it.

State Goods and Services Tax (SGST)

- It is levied by the state government.

- It is also levied on intra-state supplies of goods and services.

- Example: If a sale occurs in Delhi, the Delhi government will simultaneously levy SGST.

Integrated Goods and Services Tax (IGST)

- It is collected by the central government, but a portion of it is later distributed among the states.

- It is levied on inter-state trade or supplies.

- Example: If goods are shipped from Delhi to Maharashtra, they will be subject to IGST.

Compensation Cess

- An additional cess is levied on certain goods (such as luxury cars, tobacco, aerated drinks, etc.).

- Its purpose is to compensate states that were earning more in tax collection before the implementation of GST for the revenue loss.

GST Rates (Tax Slabs)

GST in India is divided into different rates so that essential goods remain affordable and luxury goods are taxed more.

0% Tax Rate

- Essential goods: milk, wheat, rice, fruits, vegetables

5% Tax Rate

- Daily consumption items, some services

12% Tax Rate

- Processed foods, mobile phones, etc.

18% Tax Rate (Standard Rate)

- Most goods and services fall here

28% Tax Rate

- Luxury goods and harmful items: cars, tobacco products, pan masala

Features of the GST Structure

- Dual Model: Central and state governments both levy taxes.

- Input Tax Credit (ITC): Tax paid at one stage can be adjusted at the next stage.

- Transparency: Entire system operated digitally through GSTN.

- Revenue Balancing: States compensated through Compensation Cess.

👉 In short, GST is structured in such a way that it provides equal opportunities to all states, reduces tax evasion and provides relief to consumers from tax on tax (cascading effect).

Vallejo Model Paint / Primer

Click below to view full product details and the latest price on Amazon.

👉 View on Amazon*As an Amazon Associate, I earn from qualifying purchases.

GST Tax Slabs

The Goods and Services Tax (GST) in India is designed to impose lower taxes on essential goods and higher taxes on luxury or harmful goods. Different tax slabs have been established for this purpose.

Zero Tax Rate (0%)

Essential goods are placed in this category to provide relief to the general public.

- Milk, eggs, wheat, rice, fresh fruits, vegetables, salt, books, etc.

5% Tax Rate

- Packaged food items, tea bags, spices, domestic gas, railway tickets (Sleeper Class), etc.

12% Tax Rate

- Mobile phones, processed food, medicines, clothing (valued over ₹1,000), etc.

18% Tax Rate (Standard Rate)

- Restaurant services, electronics, computers, beauty products, insurance, banking services, etc.

28% Tax Rate

- Cars, motorcycles, tobacco products, pan masala, aerated drinks, etc.

Compensation Cess

- In addition to 28%, additional cess on items such as SUVs, tobacco, pan masala, etc.

Main Objectives of GST Rate Structure

- Provide relief to the poor and middle class.

- Keep essential goods affordable.

- Increase revenue via luxury and harmful goods.

Impact of GST

The Goods and Services Tax (GST), implemented in India on July 1, 2017, was a historic change in the country’s tax system. Its implementation simplified the tax structure, but also brought forth several challenges. Its impact can be seen in both positive and negative ways.

Positive Impacts (Benefits)

(a) Simplification of the Tax System

GST eliminated several indirect taxes, such as excise, service tax, VAT, and octroi, creating a single tax system. This made doing business easier.

(b) Elimination of the “Cascading Effect”

Previously, different taxes were levied at each stage, increasing the final price. GST eliminated this problem through input tax credit (ITC).

(c) Ease of Doing Business

GST created a unified nationwide market. Companies no longer have to pay separate taxes for different states.

(d) Promotion of Digitalization

GST is entirely online—registration, returns, and payments all happen via the GSTN portal, increasing transparency.

(e) Increased Government Revenue

The tax base expanded and tax evasion declined. Revenue collection steadily increased.

Negative Impacts (Challenges)

(a) Complexity for Small Businesses

Monthly/quarterly returns and digital compliance are difficult for small businesses.

(b) Constant Changes

Regular revisions in tax rates and rules cause confusion.

(c) Technical Issues

GSTN portal glitches often make return filing difficult.

(d) Exclusion of Certain Sectors

Alcohol, petroleum, and electricity remain outside GST, preventing a fully unified tax system.

(e) Initial Shocks

Businesses had to adapt to new processes, leading to temporary drops in activity initially.

Overall Perspective

- For consumers: Essential goods became cheaper, some services became costlier.

- For businesses: Long-term benefits, but initial compliance difficult.

- For the government: Revenue and transparency increased.

Overall, GST has modernized, transparent, and integrated India’s tax system. While challenges still exist, continued reforms and state-central partnerships are strengthening the system.

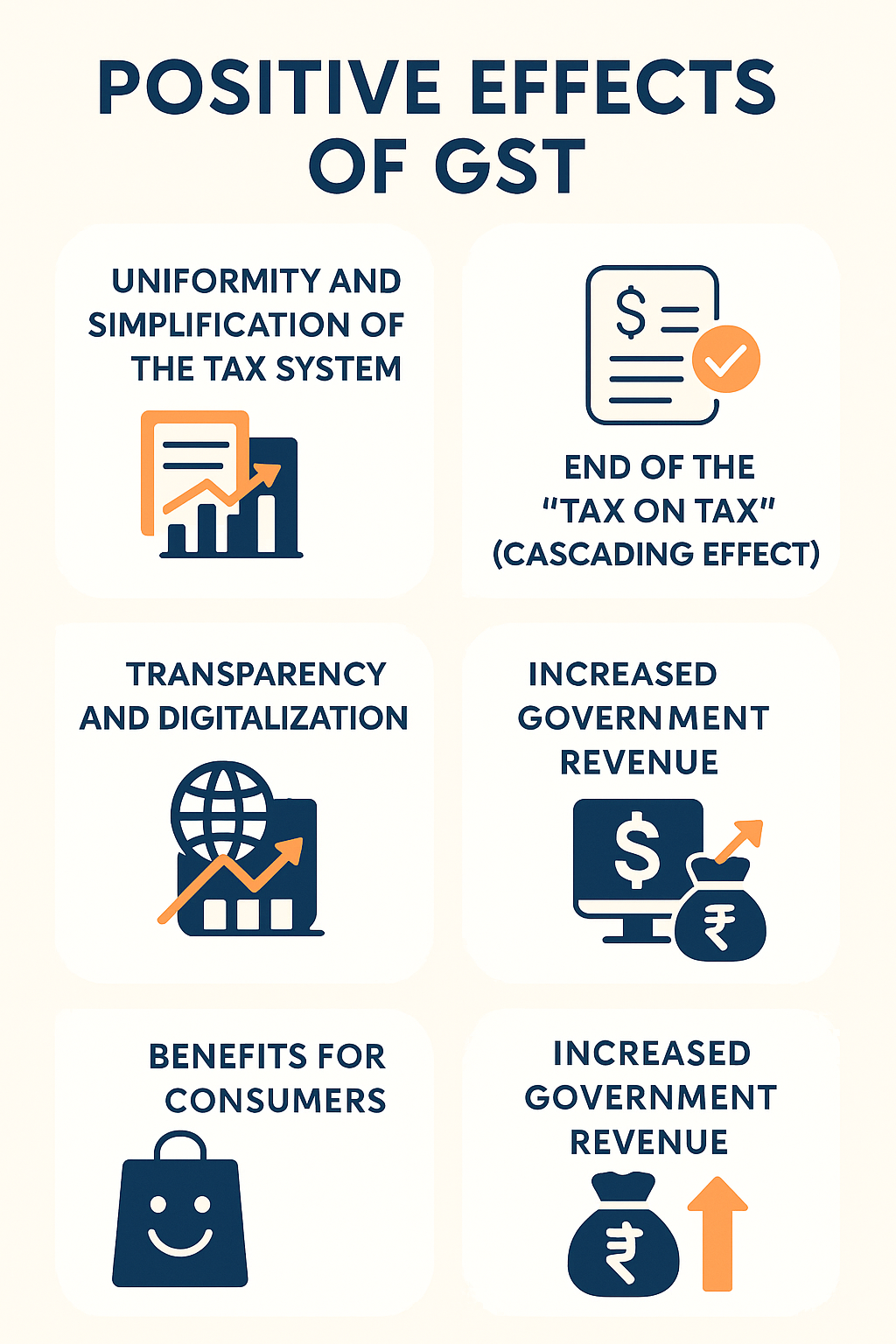

Positive Effects of GST

The implementation of the Goods and Services Tax (GST) in India has brought about several major and positive changes to the country’s tax system. It not only simplifies the tax structure but also has a positive impact on both business and the economy. Let’s understand its major positive impacts:

Uniformity and Simplification of the Tax System

- GST eliminated several indirect taxes such as excise duty, service tax, VAT, octroi, and entry tax.

- This strengthened the concept of “one nation, one tax” across the country.

- Traders no longer have to deal with different tax systems in different states.

Amazon Product

Click below to view full product details and the latest price on Amazon.

👉 View on Amazon*As an Amazon Associate, I earn from qualifying purchases.

End of the “Tax on Tax” (Cascading Effect)

- Previously, a single item was taxed multiple times from production to sale.

- GST now offers Input Tax Credit (ITC), allowing traders to offset the taxes paid on goods/services they purchase.

- This makes goods and services cheaper for the end consumer.

Ease of Doing Business

- Before GST, different states had different tax rules, making interstate trade difficult.

- A uniform tax system has made operations easier for companies and industries.

- The Indian market has also become more attractive to foreign investors.

Transparency and Digitalization

- The entire GST framework is based on an online portal (GSTN).

- Registration, tax payment, and return filing are all digital.

- This has curbed tax evasion and reduced corruption.

Increased Government Revenue

- GST has expanded the tax base and brought more people under the tax net.

- Tax collection has steadily increased, benefiting both central and state governments.

Benefits for Consumers

- Essential goods and services have been taxed at lower rates, providing relief to the public.

- The unified tax system has made prices more stable and transparent.

GST has made India’s tax system more transparent, simple, and modern. This not only benefits businesses and industries, but is also beneficial for both consumers and the government.

Negative Effects of GST

GST (Goods and Services Tax) is a major reform of India’s tax system, but it has also had some negative impacts.

Pressure on Small Businesses

- Small and medium-sized businesses find online registration, return filing, and digital payments cumbersome.

- Increased tax compliance has raised their operational time and cost.

Technical Challenges

- GST is completely online, but lack of internet and digital literacy in rural areas poses difficulties.

- Portal glitches make return filing difficult.

Complaints about High Tax Rates

- GST rates up to 28% reduced demand for some goods.

- Luxury and automobile sectors were especially affected.

Cash Flow Problems

- ITC delays caused cash flow issues.

- The MSME sector faced the most difficulties.

Initial Confusion and Lack of Training

- Frequent early changes in laws and rates caused confusion.

- Businesses and the public lacked awareness and training.

Impact on Inflation

- Prices of many services and goods increased after GST implementation.

- Restaurants, hotels, and daily use items became costlier initially.

Impact on the Unorganized Sector

- Previously untaxed sectors came under GST.

- Small unorganized businesses faced compliance challenges.

👉 These negative aspects show that GST is still on a journey of improvement. These challenges can be mitigated by appropriate policy changes and simplification.

Major Challenges of GST

GST has played a significant role in simplifying and unifying the Indian tax system, but its implementation and operation have faced several challenges.

Technical Infrastructure

- GST is a completely online system.

- Frequent glitches occur on the GSTN portal.

- Rural traders struggle due to poor internet access and digital skills.

Complex Compliance Process

- Monthly return filing and ITC reconciliation is difficult for small traders.

- Frequent changes in rules create confusion.

Uncertainty in Revenue Collection

- Many states did not receive expected revenue.

- State–centre disputes emerged over compensation payments.

Impact on Small and Unorganized Businesses

- The unorganized sector was brought under GST.

- Compliance costs reduced their competitiveness.

Difficulties with Input Tax Credit (ITC)

- Every trader in the supply chain must be tax-compliant to claim ITC.

- Delays affect cash flow for smaller businesses.

Complexity of Tax Rates

- GST has multiple rates—0%, 5%, 12%, 18%, and 28%.

- This raises questions about “one nation, one tax.”

Tax Evasion and Fraud

- Fake invoices and fraudulent ITC claims continue to be an issue.

- This increases the burden on tax administration.

Lack of Awareness and Training

- Many small businesses do not fully understand GST.

- Insufficient training and helpdesk support creates compliance issues.

👉 Given these challenges, it is important for the government and policymakers to make GST more simple, transparent, and business-friendly.

Current Status of GST (by 2025)

It has been almost eight years since GST was implemented in India. During this period, numerous changes, improvements, and amendments have impacted businesses, industries, and consumers. The status of GST by 2025 can be understood in the following points:

Widespread Acceptance

- After the difficulties of the initial years, most businesses and industries have now adapted to the GST system.

- GST compliance has become easier for large organizations and MNCs, while the MSME sector is also gradually integrating with the digital infrastructure.

Increase in Tax Collection

- Revenues for the central and state governments are steadily increasing.

- GST collections have reached ₹1.8–2 lakh crore per month in several months by 2024–25, proving it to be a stable revenue source.

Technological Improvements

- The GSTN portal and mobile apps have been significantly improved.

- E-invoicing and e-way bill systems have increased transparency and curbed tax evasion.

- Artificial intelligence-based monitoring has reduced fake invoice scams.

Stability in Tax Rates

- Tax rates now change less frequently than in the initial years.

- The government aims to further simplify GST by reducing it from four slabs to three.

- Consumers have been provided relief by placing many essential items in lower slabs.

Challenges for MSMEs and Small Traders

- Although the system has been simplified for large industries, compliance is still considered complex for small traders.

- The government has introduced options like QRMP (Quarterly Return Monthly Payment) and the composition scheme, but complete simplification is still desired.

Balance between States and the Center

- Even after the abolition of the compensation cess, discussions periodically occur regarding the revenue loss of states.

- The GST Council has resolved many disputes together, strengthening the spirit of “Cooperative Federalism.”

Impact on Consumers

- While many services have become cheaper, some luxury products remain expensive.

- Overall, consumers have benefited from a “one tax, transparent tax” system.

By 2025, GST has become the backbone of India’s tax system. Its focus now is on simplifying the rate structure, making compliance easier for MSMEs, and maintaining stable revenue collection.

Conclusion

GST (Goods and Services Tax) is a landmark reform of India’s tax system that actualized the concept of “one country, one tax, one market.” Before its implementation, the country’s tax structure was complex and multi-layered, but GST eliminated various indirect taxes and consolidated them into a unified system.

As 2025 approaches, it is clear that GST has significantly contributed to business transparency, tax collection, and economic integration. However, issues such as compliance complexity, technical challenges, and revenue balance remain for small businesses.

Overall, GST has provided India with a unified national market and curbed tax evasion. If tax slabs are further simplified, rules for the MSME sector are eased, and technical infrastructure is further strengthened in the coming years, GST will not only strengthen India’s tax system but also elevate the country’s economic growth and global competitiveness to new heights.

Amazon Product

Click below to view full product details and the latest price on Amazon.

👉 View on Amazon*As an Amazon Associate, I earn from qualifying purchases.

Reference To GST

Official Government Sources

- GST Council Official Website: https://gstcouncil.gov.in

- Goods and Services Tax Network (GSTN): https://www.gst.gov.in

- Central Board of Indirect Taxes and Customs (CBIC): https://cbic-gst.gov.in

Parliament and Legislative Documents

- Constitution (122nd Amendment) Act, 2016

- GST Act 2017 (CGST Act, IGST Act, UTGST Act, Compensation to States Act)

Reports and Studies

- Comptroller and Auditor General of India (CAG) Reports on GST

- NITI Aayog Reports on GST & Indian Economy

- RBI Bulletin – GST Collections Data

News and Expert Articles

- The Hindu Business Line, Economic Times, Business Standard – GST Updates & Analysis

- PRS Legislative Research – GST Briefs and Reports

GST ki do slip 5% aur 12% karke mahangai ko kam Kiya hai Ishq se fayda hoga tatha sadharan vyaktiyon ki bhi kshamta badhai