India in Economic Improvement

Summary: A clear, story-like review of India’s economic reforms starting in 1991, their background, main features, sectoral impact, benefits and challenges, and the reforms' status through 2014–2025.

1. Introduction

India’s major economic reforms began in 1991, at a moment when the country faced a serious economic crisis. The government then redirected the economy through policies of liberalisation, privatisation, and globalisation (commonly called the LPG reforms). These reforms opened India to market forces, reduced direct state control in many sectors, and encouraged integration with the global economy.

2. Background to the Reforms

At the start of the 1990s India was struggling with several macroeconomic problems that triggered reform:

- Depleting foreign exchange reserves and a balance of payments crisis.

- Large fiscal deficit and persistent budgetary stress.

- Low industrial growth and constrained private investment.

- Dependence on foreign assistance from institutions such as the World Bank and the IMF to stabilise the economy.

3. Main Features of the Economic Reforms

(i) Liberalisation

- Dismantling of the licence-permit raj — licensing requirements were reduced or removed for many industries.

- Reduction of controls on imports and exports.

- Reduced government interference in industrial decisions and greater autonomy for businesses.

- Move toward market-determined exchange rates.

(ii) Privatisation

- Privatisation and disinvestment in public sector undertakings to encourage private participation.

- Creation of more opportunities for the private sector in formerly public domains.

- Adoption of a formal disinvestment policy to raise resources and improve efficiency.

(iii) Globalisation

- Increased incentives and access for foreign direct investment (FDI).

- Easier entry for foreign companies into the Indian market.

- Greater engagement with global economic institutions such as the WTO, IMF, and World Bank.

4. Key Areas of Improvement

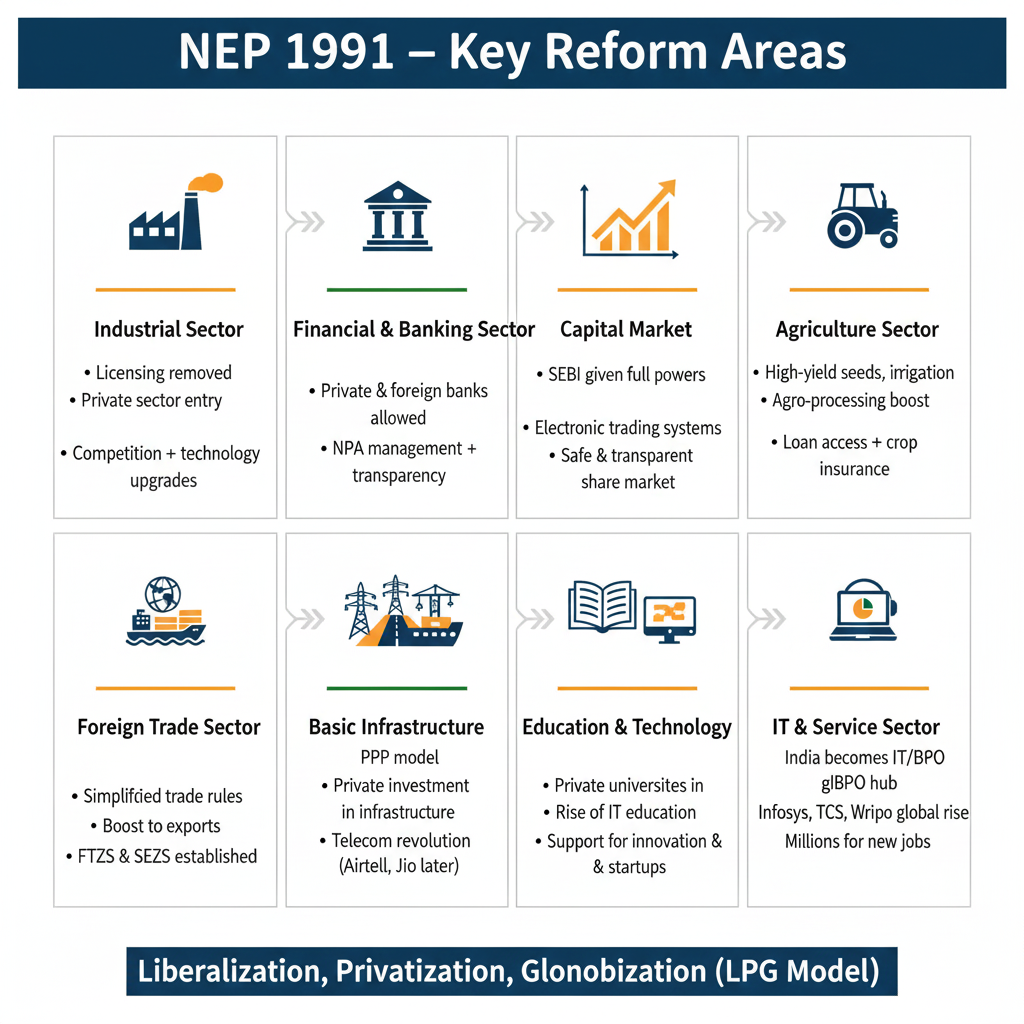

The reforms affected multiple sectors. The table below summarises important changes.

| Area | Main Improvements |

|---|---|

| Industrial Policy | End of restrictive licensing; adoption of the New Industrial Policy (1991) that encouraged private investment and competition. |

| Financial Sector | Banking reforms, entry of private banks, and a gradual shift in the regulator's role (RBI) toward supervision and market stability. |

| Fiscal Policy | Reduction in subsidies over time and tax reforms culminating in a more unified indirect tax system (GST introduced later). |

| External Trade Policy | Liberalisation of import–export rules and a shift to more open trade policies. |

| Agriculture | Measures such as better seed technology, gradual reforms in procurement and marketing (APMC reform debates), and attention to MSP—though progress has been uneven. |

| Infrastructure | Greater private investment in roads, power, and transport; initiatives to expand basic physical infrastructure. |

5. Benefits of the Reforms

- Higher GDP growth rates over the medium and long term compared to the pre-1991 period.

- Significant growth in foreign direct investment (FDI) inflows.

- Rapid expansion of the services sector (IT, BPO, finance, etc.).

- Creation of new employment opportunities in emerging industries.

- Improved choices and access for consumers through greater competition and imports.

6. Challenges Arising from the Reforms

- Uneven development: The urban–rural divide widened in many areas, with cities capturing much of the new investment and jobs.

- Social concerns: Rapid privatisation raised worries about social security and equitable access to services.

- Agricultural neglect: Some agricultural regions have not kept pace with industrial and service-sector gains.

- Labour issues: Informalisation and worker protection remain policy challenges.

- Market concentration: The growing presence of large foreign firms generated concerns about domestic competition and dominance in some sectors.

7. Current Status of Reforms (2014–2025)

From around 2014 through 2025, the reform agenda continued with new flagship initiatives and policy changes:

- Goods and Services Tax (GST, 2017): Integration of multiple indirect taxes into a single tax regime to simplify commerce across states.

- Make in India & Startup India: Policies to boost manufacturing and entrepreneurship.

- Digital India: Large-scale push for digital infrastructure, services, and adoption.

- Banking reforms: Measures to address non-performing assets (NPAs) and consolidation through mergers.

- Production Linked Incentive (PLI) schemes: Incentives to boost domestic manufacturing in strategic sectors.

- Self-reliant India (Aatmanirbhar Bharat): Emphasis on strategic domestic capabilities and resilience.

8. Conclusion

The economic reforms that began in 1991 transformed India's economy and brought it onto the global stage. While the reforms produced strong growth, greater foreign investment, and a booming services sector, they also revealed social and regional imbalances. Looking ahead, the priority should be to pursue inclusive, sustainable, and employment-oriented reforms so India can become a stronger, self-reliant, and advanced economy that benefits a broader segment of its population.

1. Introduction

India’s economic reforms, initiated in 1991, marked a historic turning point. At that time, the country was facing a deep economic crisis—foreign exchange reserves were nearly exhausted, and the Balance of Payments situation had become extremely unstable. In response, the government adopted a three-tier policy of Liberalization, Privatization, and Globalization (LPG).

The purpose of these reforms was to transform the Indian economy from a highly controlled structure into a competitive, open, and market-based system. This shift influenced not only the economic framework but also brought significant social and political impact.

Through this introduction, we aim to understand why economic reforms were needed, what their structure was, and in which direction they pushed India’s economy.

2. Economic Reforms: Background

The economic reforms introduced by India in 1991 were driven by several deep and serious challenges. The economy was going through an intense crisis, forcing the government to take bold and urgent steps.

(i) Heavy Foreign Debt and Balance of Payments Crisis

India’s burden of foreign debt had risen sharply, and foreign exchange reserves had fallen to dangerously low levels. By July 1991, India had barely enough reserves to pay for two weeks of essential imports.

(ii) High Fiscal Deficit

Government expenditure was increasing rapidly while revenue growth was weak. In 1990–91, the fiscal deficit reached 8.4% of GDP, worsening inflation and creating economic instability.

(iii) Licence Raj and Excessive Government Control

From 1947 to 1991, the Indian economy operated largely under the “Licence Raj.” Setting up, expanding, or even operating industries required multiple government clearances. This excessive control slowed the growth of the private sector and restricted innovation.

(iv) Global Pressure and Role of IMF & World Bank

In 1991, India sought financial assistance from the IMF and World Bank. In return, these institutions recommended structural reforms and liberalisation measures. This compelled the government to redesign its economic policies.

(v) Rise in Oil Prices and Gulf War Impact

The Gulf War (1990–91) led to a sharp rise in crude oil prices, which significantly increased India’s import bill. This deepened the foreign exchange crisis further.

(vi) Declining Economic Growth

Towards the end of the 1980s, India's growth rate began to slow down. Industrial and agricultural progress stagnated, unemployment rose, and poverty-related concerns worsened.

All these reasons combined forced the government to acknowledge that the old, restrictive policy framework could no longer support the nation’s progress.

In this situation, under the leadership of Prime Minister P.V. Narasimha Rao and Finance Minister Dr. Manmohan Singh, the New Economic Policy (NEP) 1991 was implemented—creating a historic transformation in India’s economic journey.

3. Economic Reforms: Main Features

The economic reforms introduced in India since 1991 aimed to reduce excessive government control, strengthen market forces, and integrate India with the global economy. These reforms are popularly known as the LPG Policy, i.e., Liberalisation, Privatisation, and Globalisation.

Below is a detailed explanation of these three major components:

(i) Liberalisation

Liberalisation refers to removing unnecessary controls, restrictions, and regulations imposed by the government so that the private sector can operate with more freedom.

Main Steps:

- Abolition of the industrial licensing system (except for a few sensitive industries).

- Relaxation in the Foreign Exchange Regulation Act (FERA).

- Interest rates made market-determined instead of government-regulated.

- Ending price controls on many commodities.

- Reforms in the banking and insurance sectors.

Detailed Key Aspects

1. Liberalisation in the Industrial Sector

- Industrial licensing removed for all but 18 industries.

- Government permission no longer required for most new industries.

- Regional restrictions removed—private industries could be set up anywhere.

2. Trade Liberalisation

- Simplification of import–export licensing.

- Relaxation in foreign exchange regulations.

- Reduction in import duties.

- Establishment of Export Processing Zones (EPZs).

3. Financial Sector Liberalisation

- Interest rates became market-based.

- Permission given to private and foreign banks to operate in India.

- Greater autonomy granted to the Reserve Bank of India (RBI).

- Higher transparency introduced in the stock and capital markets.

4. Relaxation in Price Controls

- Prices of many goods (e.g., petroleum products, fertilizers, steel) became market-driven.

- Government subsidies gradually reduced.

5. Growth in Technology & Service Sector

- Opening of IT, telecommunications, and insurance sectors for private companies.

- Issuing licences to private telecom companies.

Benefits of Liberalisation:

- Higher industrial growth rate.

- Improved investment climate.

- Entry of foreign companies and technology transfer.

- More competition and greater choice for consumers.

Challenges:

- Uneven development—major benefits concentrated in big cities.

- Risk of monopoly by large private firms.

- Weaker social security for vulnerable groups.

Conclusion: Liberalisation opened India’s closed economy to the global market, accelerating growth and creating new opportunities, though social and regional imbalances also emerged.

(ii) Privatisation

Privatisation means transferring ownership or management of government-run industries, services, or institutions to the private sector, or allowing private investment in these areas. The goal is to improve efficiency, reduce government burden, and promote competition.

Main Objectives of Privatisation:

- Improve efficiency and accountability of public enterprises.

- Reduce financial burden on the government.

- Increase competition.

- Benefit from private-sector innovation and efficiency.

Key Measures:

1. Disinvestment

- Selling government equity in public sector companies.

- Examples: BPCL, Air India, Maruti Udyog, VSNL.

- Creation of the Department of Disinvestment (now DIPAM).

2. Reduction of Government Control

- Private companies allowed in sectors such as telecom, aviation, power, insurance, and banking.

- Example: Earlier telecom was limited to BSNL/MTNL; later private firms like Airtel and Jio entered.

3. Public-Private Partnership (PPP)

- Adoption of PPP models in infrastructure, transport, education, and healthcare.

- Government and private companies jointly contribute.

4. Shutdown or Sale of Loss-Making PSUs

- Loss-incurring public sector enterprises were closed or sold.

- Helped reduce unnecessary government expenditure.

Benefits of Privatisation:

- Higher efficiency and productivity.

- Better services for consumers.

- Boost in innovation due to competition.

- Government can focus more on welfare functions.

- Increase in foreign investment.

Challenges & Criticism:

- Fear of job insecurity and layoffs.

- Concerns about exploitation in essential services.

- Debate regarding selling national assets at low prices.

- Threat of monopolies by large corporates.

- Ethical concerns in sectors like education and healthcare.

Conclusion: Privatisation improved service quality, efficiency, and competition but must be balanced with social justice, employment security, and protection of public interest.

(iii) Globalisation

Globalisation means integrating a country’s economy, culture, capital, trade, and information systems with the rest of the world. Under the 1991 reforms, India opened its economy to global markets, leading to increased foreign investment, technology adoption, and international trade.

Main Objectives of Globalisation:

- Attract foreign capital and technology.

- Make Indian industries competitive globally.

- Promote exports.

- Reduce barriers to international business.

- Participate in global innovation and development.

Key Steps:

1. Expansion of Foreign Direct Investment (FDI)

- Many sectors opened for up to 100% FDI (e.g., automobiles, telecom, insurance, retail).

- Access to global technology and capital.

- India became an attractive destination for investors.

2. Trade Reforms

- Reduction of import duties and removal of quotas.

- Establishment of Export Processing Zones.

- Tax incentives and facilities for exporters.

- Campaigns like “Make in India” boosted global demand.

3. Integration with Global Institutions

- India joined the World Trade Organization (WTO) in 1995.

- Adopted global trade norms.

- Followed structural reform guidelines from IMF and World Bank.

4. Entry of Multinational Companies (MNCs)

- Foreign companies began manufacturing and investing in India.

- Consumers gained access to global brands and better products.

- Modern management practices and technology entered India.

5. Growth in Communication & IT

- Expansion of internet, mobile, and digital services.

- India became a global hub for IT and BPO services.

Benefits of Globalisation:

- Increase in foreign investment and capital flow.

- New employment opportunities, especially in IT and services.

- Access to global technology and innovation.

- More choices and better quality for consumers.

- Indian companies like Tata, Infosys, and Reliance expanded globally.

Challenges & Negative Effects:

- Threat to local industries due to foreign competition.

- Cultural influence of Western lifestyles.

- Uneven development—urban areas benefited more.

- Increased dependency on foreign companies.

- Environmental pressure due to rapid industrialisation.

Conclusion: Globalisation transformed India from a closed economy into a competitive player on the world stage. While growth accelerated, it is essential to ensure that globalisation is inclusive, balanced, and sustainable for all sections of society.

4. Chief Areas of Improvement

Under the New Economic Policy of 1991, the Government of India introduced comprehensive reforms in various sectors to accelerate economic growth. The objective was to enhance efficiency, attract investment, promote competition, and align the economic system with global standards.

Below is a detailed description of the major areas where reforms were implemented:

(i) Improvements in the Industrial Sector

- Relaxation of industrial licensing; most industries no longer required licences.

- Private sector allowed entry into previously restricted sectors.

- Reduction in government control led to increased investment and production.

- Improved product quality due to competition and technological upgrades.

(ii) Improvements in the Financial and Banking Sector

- Interest rates made market-based instead of government-regulated.

- Permission granted to private and foreign banks to operate in India.

- Reforms introduced to reduce and manage Non-Performing Assets (NPAs).

- Amendments to the Banking Regulation Act increased transparency and accountability.

(iii) Improvements in the Capital Market

- SEBI (Securities and Exchange Board of India) was given more regulatory powers.

- Share markets made more transparent, regulated, and safe for investors.

- Electronic trading systems were introduced, increasing investor convenience.

(iv) Improvements in the Agriculture Sector

- Promotion of advanced seeds, fertilizers, irrigation technologies, and mechanization.

- Subsidies and facilities introduced to encourage agricultural exports.

- Boost to agro-processing and industries linked to agriculture.

- Improved loan access and crop insurance schemes for farmers.

(v) Improvements in the Foreign Trade Sector

- Simplification and transparency in import–export licensing systems.

- A shift in foreign trade policy to boost exports.

- Establishment of Free Trade Zones (FTZs) and Special Economic Zones (SEZs).

(vi) Improvements in Basic Infrastructure

- Encouragement of private investment in roads, railways, ports, power, and telecommunications.

- Promotion of Public-Private Partnership (PPP) models.

- Revolution in telecom and internet services with the entry of brands like Jio and Airtel.

(vii) Improvements in Education and Technology

- Recognition and expansion of private universities and institutions.

- Boost to IT and computer education.

- Support for technology startups and innovation.

(viii) Improvements in the IT and Service Sector

- India emerged as a global leader in IT and BPO services.

- Companies like Infosys, TCS, and Wipro gained significant international recognition.

- Creation of millions of employment opportunities.

Conclusion: Reforms across these sectors not only accelerated India’s economic growth but also strengthened its global position. However, ensuring that the benefits of these reforms reach all sections of society remains an ongoing challenge.

5. Benefits of Economic Reforms

Since the introduction of liberalisation, privatisation, and globalisation in 1991, India has witnessed numerous positive transformations. These reforms helped the economy transition toward a faster-growing, more competitive structure.

1. Higher Economic Growth Rate

- India’s GDP growth rate increased significantly after the reforms.

- While growth in the 1980s was around 3–4%, post-reform growth reached 6–8%.

2. Increase in Foreign Investment (FDI & FII)

- Liberalisation and globalisation attracted large foreign investments.

- This brought capital, technology, and new job opportunities.

3. Expansion of the Private Sector

- As the role of the public sector reduced, private companies expanded rapidly.

- Brands like Tata, Reliance, Infosys, and Wipro became globally recognised.

4. Rapid Growth in the Services Sector

- Major growth in IT, telecom, banking, tourism, and other services.

- The services sector now contributes more than 50% to India’s GDP.

5. New Employment Opportunities

- Millions of jobs created in IT, BPO, retail, telecom, and other sectors.

- Both rural and urban employment options increased.

6. Benefits to Consumers

- Greater competition made goods and services more affordable and higher in quality.

- Consumers gained access to a wider variety of brands and products.

7. Growth in Technology and Managerial Efficiency

- Entry of foreign companies brought new technologies and modern management practices.

- Improved productivity and quality across industries.

8. Strengthening India’s Position in the Global Market

- Indian companies began competing globally.

- Exports increased, especially in services and IT.

9. Improvement in Infrastructure

- Investments in roads, airports, power, ports, and logistics increased through PPP models.

- Enhanced availability of basic facilities.

10. Boost to Entrepreneurship

- Removal of licence requirements and simplified policies encouraged startups.

- Today, India has emerged as a major global startup hub.

Conclusion: Economic reforms transformed India into a more self-reliant, competitive, and globally connected economy. They not only accelerated economic growth but also improved social development and living standards across the country.

6. Challenges of Economic Reforms

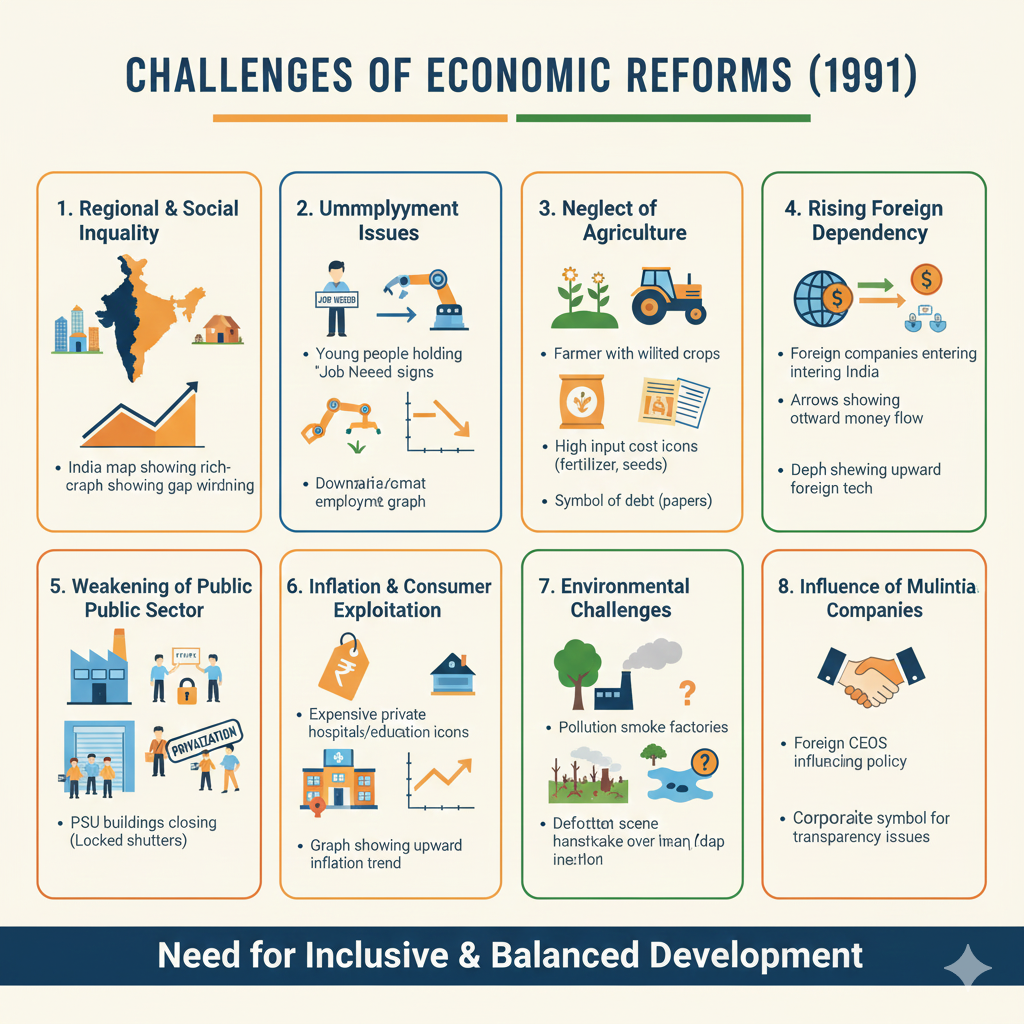

While the 1991 reforms gave India a new direction, they also brought several challenges and inequalities. Some sections benefited significantly, while others lagged behind. Therefore, it is important to evaluate both the limitations and side effects of these reforms.

1. Regional and Social Inequality

- Most economic benefits were concentrated in urban and wealthy areas.

- Rural, backward, and tribal regions did not receive expected benefits.

- Lower and middle-income groups continued to face long-standing problems.

2. Unemployment Issues

- Despite reforms, employment generation was slow, especially in the organised sector.

- Technology-based industries reduced the need for manual labour.

- Youth unemployment became a major concern.

3. Neglect of the Agriculture Sector

- Economic reforms focused mainly on industrial and service sectors.

- Agriculture growth remained limited, affecting farmer incomes.

- Issues such as debt, rising input costs, and farmer suicides increased.

4. Rising Foreign Dependency

- Globalisation increased dependence on foreign capital, technology, and companies.

- This raised concerns about long-term economic sovereignty.

5. Weakening of the Public Sector

- Privatisation led to closure or sale of several public sector undertakings.

- Job security reduced, affecting social welfare.

- Some sectors faced risks of private monopolies.

6. Inflation and Consumer Exploitation

- In some cases, companies charged excessively in the name of competition.

- Privatisation in key sectors (education, health, transport) increased prices.

- This made essential services less affordable for low-income groups.

7. Environmental Challenges

- Industrialisation and urbanisation increased pollution and deforestation.

- Environmental protection was often neglected in the race for development.

8. Influence of Multinational Companies

- In some sectors, foreign companies began influencing domestic policies.

- This raised concerns about transparency and democratic decision-making.

Conclusion: Economic reforms modernised India’s economy, but also resulted in inequalities, unemployment, agriculture distress, and environmental issues. Balanced and inclusive development is essential to ensure that the benefits of reforms reach every section of society.

7. Current Status of Reforms (2014–2025)

After 2014, the Government of India accelerated economic reforms to build a stronger, self-reliant, and globally competitive economy. These reforms brought significant changes in business policies, investment environment, digital technology, and labour laws.

(i) Implementation of Goods and Services Tax (GST)

- GST was implemented in 2017, creating a unified indirect tax system.

- Earlier, multiple state and central taxes complicated trade and increased costs.

- GST turned India into one common market, making business operations easier.

(ii) Digitalisation and the Digital India Campaign

- Promotion of digital services, e-governance, online transactions, and digital payments.

- UPI, BHIM, and other digital platforms boosted cashless transactions.

- Efforts made to deliver digital technology to small businesses and farmers.

(iii) Labour Reforms

- In 2020, numerous labour laws were consolidated into three major Labour Codes.

- The aim was to simplify rules and attract investment.

- Worker safety and industrial flexibility were both given priority.

(iv) Make in India Initiative

- Launched in 2014 to develop India as a major global manufacturing hub.

- Encouraged foreign and domestic investment in key sectors.

- Growth seen in defence, electronics, and automobile manufacturing.

(v) Startup India and Innovation Support

- Startups received tax benefits, easy loan support, and incubation facilities.

- Encouragement for research, innovation, and R&D investments.

- India emerged as a major global startup hub.

(vi) Infrastructure Development

- Rapid development in roads, railways, ports, and airports.

- Smart City projects were launched.

- Clean and renewable energy sectors gained momentum.

(vii) Liberalisation of Foreign Investment

- FDI limits were increased in several sectors, including defence, media, and retail.

- An attractive investment environment encouraged global investors.

(viii) Agriculture Reform Attempts

- Reforms were attempted to liberalise agricultural marketing (though controversial).

- Focus on modern technologies and improved market access for farmers.

Conclusion: Between 2014 and 2025, India undertook major reforms in taxes, labour laws, digitalisation, infrastructure, and investment policies. These steps strengthened India’s global competitiveness. However, continuous review and adjustments are necessary to ensure that all sections of society benefit equally.

8. Conclusion

The economic reforms of 1991 not only rescued India from a severe crisis but also gave the country a new direction and momentum. Through liberalisation, privatisation, and globalisation, India entered the global economic system with a stronger presence. These reforms led to higher economic growth, increased foreign investment, and the creation of new industries and employment opportunities.

However, the reforms also brought challenges such as regional inequality, neglect of agriculture, unemployment, and environmental concerns. Without addressing these issues, long-term inclusive development is not possible.

Reforms undertaken between 2014 and 2025—such as GST, digitalisation, labour reforms, Make in India, and Startup India—further strengthened India’s path toward becoming a strong, self-reliant, and globally competitive economy.

Ultimately, the true success of economic reforms lies in ensuring that their benefits reach every social group and in adopting development policies that are continuous, balanced, and inclusive. With sustained efforts, India can secure its position as a major global economic power.

References

- Government of India Reports on Economic Reforms (1991–2025)

- Reserve Bank of India (RBI) Publications and Annual Reports

- Economic Survey of India – Various Years

- Ministry of Finance – New Economic Policy (1991)

- World Bank & IMF Data on India’s Economic Growth

- NITI Aayog Research Papers & Policy Notes

- WTO Reports on India’s Global Trade Participation